Bad credit background can make it difficult to be eligible for of numerous traditional mortgage solutions. Of a lot antique financing choices need a borrower getting a good credit score to allow them to found financing acceptance.

Fortunately, a motor vehicle label mortgage serviced of the LoanMart could offer a different direction. Consumers regarding various different types of borrowing and economic experiences you can expect to potentially qualify for a title mortgage! step 1

Vehicle identity funds for the Fl is shielded through security, which is the name to the borrower’s automobile. This enables a debtor to make use of their vehicle’s value in place of its credit score to safer cash, while the guarantee will stop the chance so you can provide so you can individuals instead strong borrowing from the bank.

Your credit report may be sensed when you look at the approval processes, however, probably, it will not be the focus of it. 1 Instead, a loan broker will run this type of about three affairs:

Usually, less than perfect credit will mean large-interest levels when you located acceptance for the money, or if you may not actually meet the requirements at all

- Your capability to repay the mortgage Monthly

- Your earnings and you can Personal debt

- The value of Your car or truck

For individuals who keep a reliable money and you may a qualifying vehicles which have big security, your bad credit is almost certainly not difficulty! 1 Don’t allow their earlier in the day stand in ways of one’s monetary coming. You may still qualify for the cash you desire courtesy an excellent vehicle name mortgage. step one

While you are like any why not look here Florida vehicle operators, your car or truck is the fundamental supply of transport. Needless to say, you don’t want to stop trying the regular driving patterns so you’re able to have the bucks you want! That have a vehicle label loan, your vehicle are guarantee toward loan. As a result for individuals who default on your own financing, your vehicle can be repossessed to cover financial obligation.

Luckily, LoanMart is not in the market of delivering automobiles and understands how important your car or truck would be to your. If you make your repayments timely, you can keep your own normal operating regime want it is team as always. While the loan costs are customized on financial situation, things happen, along with your factors could have changed. You have got missing your task, or another unforeseen costs provides set your finances straight back.

If this sounds like the outcome, you may have issues while making your payments. To avoid an adverse condition, contact your financing representative instantly. There is a great deal more options than just do you believe, but as long as you get to aside and you will discuss the difficulty! Your loan could well be refinanced otherwise extended if you like they. step 1

How can i Apply for On the web Term Money inside the Fl?

Willing to see if your vehicle and you will earnings qualify for the fresh new bucks you desire? Since a citizen of Florida, you can access one of the quickest loan acceptance techniques online! That have label financing maintained because of the Loanlined recognition process waiting for you when planning on taking advantage of.

Have a tendency to, poor credit means large-rates of interest once you receive acceptance for cash, or if you may not also qualify whatsoever

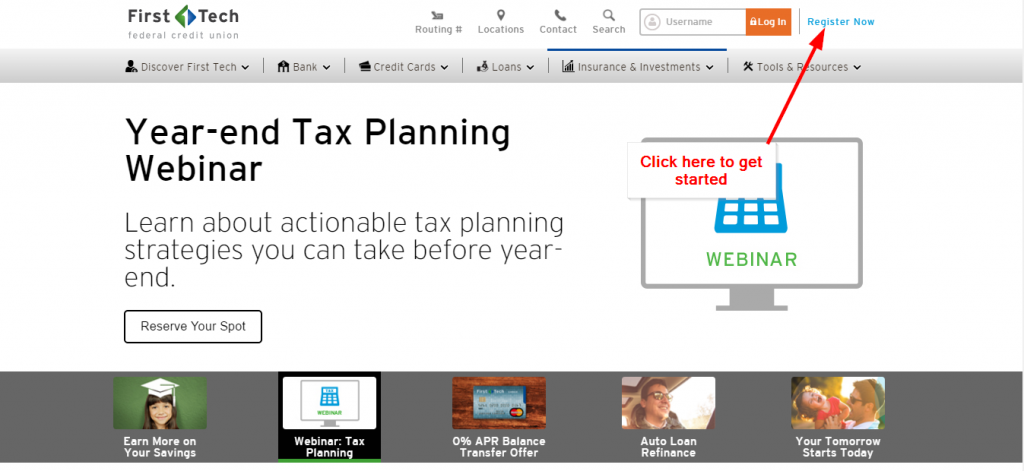

- Label or Simply click Online: The first step to position your loan query is always to favor how exactly to submit it. You could visit the website in order to fill in the fresh new query means, or name that loan representative in the 855-277-4847. Both prequalifying possibilities may take almost no time! step 3

- Complete the proper Data: As soon as your inquiry could have been processed, the next step is add the fresh documents expected to verify your details. That loan agent tend to comment them, and you may send you toward last action!

- Get approved and possess Your hard earned money 1 : If the suggestions qualifies for cash, the final step should be to sign the loan deal immediately after acquiring loan recognition! In this action, you can speak about your percentage package and you may financing terms and conditions together with your mortgage broker. From there, you could potentially signal your own price, and pick some of these solutions to pick up your hard earned money: