To prevent unnecessary inaccuracies in your loan application process, you need to fully understand the strategies on it, before you could make an effort to get that loan sanctioned.

With an online app, you can now get home financing and now have it approved in place of ever before having to check out the lender

Choosing a home loan previously used to be a generally a long time procedure. However, because of the actually ever-evolving electronic technology, you can now get a home loan about comfort of your existing household. Ideal lenders in the united states provides on the internet Mortgage application programs, made to make process optimised and you will much easier.

The borrowed funds application and you can disbursal procedure, given that already dependent, is ideal navigated once you may be obvious exactly how the lenders sanction Home loans. Consider all of the tips in delivering a beneficial construction loan sanctioned on the web.

Go to the on the internet webpage of your own selected bank to apply for a separate Mortgage otherwise a home loan equilibrium import . Discover appropriate solution and you will fill out the internet application. The form will need that present personal data and extra information about your a position, money, loan amount, and you can period.

Cross-view all inserted information in advance of hitting the Submit’ option as your Mortgage qualifications could well be determined base what you given. An enthusiastic OTP was generated and provided for your registered cellular count. Enter the OTP so you’re able to follow the next step.

The web based program tend to automatically influence your home Loan qualification and you will provide a personalized provide. You can check the maximum amount of mortgage you could avail and reveal malfunction. Monthly EMIs based on the selected loan amount, tenure, and you can rate of interest can also be considering.

This task of your own app techniques is the perfect place candidates also provide the possibility to add a good co-candidate, to improve the eligibility. An alternate mode needs to be filled out to have including an excellent co-applicant.

An excellent provisional acceptance otherwise an effective pre-approved Mortgage allows an applicant to acquire home financing approved before it finalise the house or property. If applicant knows the borrowed funds count he or she is qualified to receive, it creates household search much easier. To receive an excellent provisional approval on the financial, the brand new applicant is needed to pay an excellent log in commission online.

This new log on payment is actually a mix of this new control commission, the new CIBIL fees, plus the CERSAI fees that each and every borrower must shell out. The brand new provisional approval was delivered as a result of an elizabeth-send, merely adopting the sign on payment are paid down on line.

The next thing of the approve procedure is the perfect place you submit your property Mortgage documents . Candidates need to upload its name research, quarters research, money data files, bank comments, signature facts, an such like., to apply for the loan. Specific lenders provide a house look for-up service, in the event the candidate really wants to complete bodily data. Possessions associated files ought to be posted on line, once you’ve finalised a property.

In the event the everything is under control, the loan would-be accepted, and ensure you get your Mortgage Sanction Page. This document contains certain key information, the following:

After you’ve uploaded all required documents, the lending company usually start the approval techniques

When you are okay making use of the conditions, you will have to sign the fresh new file and send it back so you can the lending company. After you’ve finalized all the associated documents, the lending company could possibly get charge you some important property-related data files, such as the title deed, No Objection Certification (NOC), Burden Certificate, etc. When this process is over, the lending company will be sure and ensure things are manageable.

Fundamentally, the financial institution commonly disburse the mortgage number and you may produce a cheque/DD installment loans no credit check Delta in preference of owner, on your behalf. The fresh disbursal ount, according to collectively arranged words.

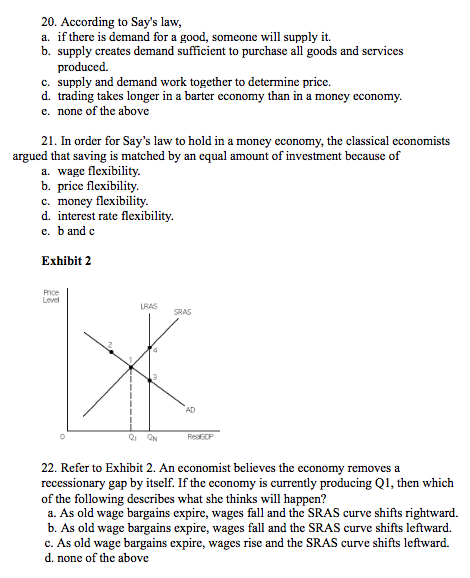

Individuals can still get in touch with the help group of your own lender discover most of the direction they want. More information in regards to the on the internet Mortgage app procedure may also be found toward certified portal of your lender. Always only get a hold of a respected lender recognized for offering Lenders at competitive costs. Best wishes together with your household research with finding your dream of being a resident, on very first.