Sign up for a mortgage inside Ca Today!

At the Defense America Home loan, the audience is happy so you’re able to suffice those who have served our very own country. I let veterans as well as their family to view reasonable mortgage brokers inside Ca, from Va, and also make their dream households a reality.

Isn’t it time to begin with your residence mortgage procedure? Next simply fill out brand new small you to definitely-second setting below to get going! We’re going to bring a zero-responsibility appointment to help you estimate simply how much you might be in a position to use.

Why must I have a good Va-Backed Mortgage for the California?

That have industry-category towns and cities such as San francisco bay area and you will Los angeles, unbelievable weather all year long, and you will a healthier lifestyle, there can be several reason why you may want to make use of your Experts Loan benefit to get your fantasy home from inside the brand new Fantastic State.

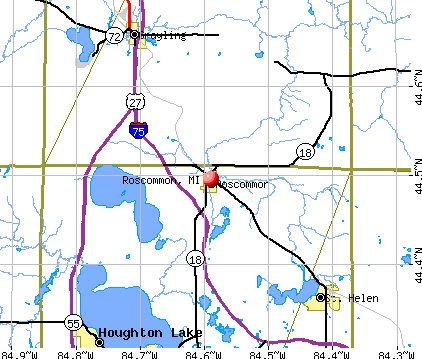

At the same time, mortgage limitations into the California cover anything from county in order to condition, depending on the construction ento’s median checklist house business pricing is $520,000 for the 2022. Basically, Va financing restrictions look for a big better-right up inside the 2022, with the simple Va mortgage maximum expanding so you can$647,two hundred versus $548,250 into the 2021. This new Virtual assistant mortgage constraints also enhanced to own high-cost counties peaking during the $970,800 having one-home. Interestingly, Va mortgage constraints is ineffective getting certified pros having complete entitlement. Although not, brand new restrictions still apply at veterans instead full entitlement.

Including, VA-Recognized Money wanted an effective 0% down-payment more often than not, whereas antique funds generally require at the very least a great step 3% downpayment and frequently around 20% required; FHA money need at least 3.5% advance payment. And you will, with a good Va Financial, experts need-not spend people monthly financial insurance policies, and therefore can’t be said on traditional otherwise FHA mortgage loans.

What exactly is an excellent Jumbo Financing in the Ca?

Of many Pros have already exploited their Va mortgage positives. Having everyday qualification criteria and freedom, its been shown to be the best choice for most so you’re able to get and you can re-finance their houses from this system. not, in a number of California areas, the new compliant loan restrict and no money off is actually $548,250. Whether your household will cost you more that it, the clear answer is actually a good Va Jumbo Loan. An excellent Va Jumbo Loan is actually one Va-Backed Financing bigger than $548,250. And you can being qualified Experts can use buying or re-finance their residence for up to a property value $1,000,000 from this version of loan, in addition to choosing every benefits associated with all round Ca Va Loan.

They are Trick Gurus you to definitely Safety The united states could possibly offer you to locate a good Virtual assistant Loans within the California

- Virtual assistant, FHA, and all of Mortgage Products.

- $0 Down payment getting Virtual assistant Mortgage brokers.

- It’s not necessary to own Individual Home loan Insurance rates.

- Aggressive hobbies prices.

- Straight down Payments.

- Easier to Be considered.

- Everyday Borrowing from the bank Conditions.

Va Financing Assessment

California Virtual assistant Lenders are finance supplied to army veterans, reservists, and energetic-obligations people to order a primary house. The fresh https://paydayloancolorado.net/loghill-village/ Pros Administration cannot lend money toward financial; alternatively, they guarantees the big 25 percent of financing from individual loan providers, instance Cover The usa Home loan, to those certified into Virtual assistant Financing Qualifications conditions.

Qualified veterans may use the mortgage benefits to buy a property having zero money off, no personal mortgage insurance rates, and also have the sellers pay all their settlement costs. These experts and you can very competitive rates generate Va Finance in Ca, the preferred financing option for of several pros.

Virtual assistant Financial Pricing and you will Will cost you

Va Fund in Ca have a similar costs associated with closure as various other financial situations, however, there are 2 key differences in closing costs having a VA-Supported Mortgage. First, if discussed for the purchase offer, the vendor pays every settlement costs and you may prepaid items, totaling around four percent of the purchase price. Second, the Service out-of Veterans Situations fees an excellent Va Funding Commission with the all of the loan they claims.

The new Va Financing Fee is actually paid back directly to the fresh new Va and you will helps to buy the home Financing System for all current and you may upcoming homebuyers. It Commission range in one.25 % to three.3 % it is waived for veterans which have services-connected disabilities. Plus, the newest Va Funding Payment will be paid-in full otherwise rolling into loan within closing.

Generally, the interest rates getting Virtual assistant Financing when you look at the California is straight down when versus traditional and FHA money. Still, you can check out our Va Finance calculator so you’re able to influence your repayments!