Solely those having very high fico scores get the best home loan sale

- DIGG

- DEL.ICIO.United states

- Stumble upon

- Myspace

- MIXX It

Solely those that have very high credit scores are receiving an educated mortgage marketing

- Hiring holds steady

- Half ‘rescued’ consumers nonetheless default

- Job attitude becomes gloomier

New york (CNNMoney) — Mortgage pricing has actually plummeted, however, one to has not made taking a home loan one more relaxing for extremely borrowers.

On the aftermath of government’s takeover regarding Federal national mortgage association and you may Freddie Mac computer last weekend, the newest 29-seasons fixed price features fell from 6.26% history Monday to help you 5.79%. But merely buyers with a credit rating from 740 away from significantly more than – and good 20% deposit – can be be eligible for including a minimal speed. Inside growth, individuals simply necessary countless 640 to help you house the lowest rates offered. Also good 580 score carry out get them extremely around the best speed.

Within the borrowing drama, Fannie mae (FNM, Fortune five-hundred) and you can Freddie Mac computer (FRE, Luck five hundred) are particularly nearly the only source of resource having finance companies and you will almost every other house loan providers seeking to create home loans. Their capability to lend is a must on housing market. To this stop, the newest Treasury often pick mortgage-supported ties about several businesses, and lend them money if necessary, all-in an effort to make borrowing more payday loan Lacoochee open to domestic customers.

But that does not mean that loan providers would not still topic borrowers in order to strict requirements, predicated on Keith Gumbinger out of HSH Couples, a tracker of mortgage guidance. The target is to build mortgage loans much more available, however, merely to the essential qualified individuals.

Due to the fact housing marketplace has actually imploded, loan providers provides battened on the hatches to your financial underwriting, continuously improving the credit scores must be eligible for the most favorable words, and leading to borrowing will cost you to pay your extra exposure circumstances it look for. That is not browsing changes.

«Credit rating influences their price more than they ever keeps ahead of,» told you Steve Habetz, a large financial company which have Tolerance Financial inside the Connecticut who has got a lot more than simply 2 decades knowledge of the company.

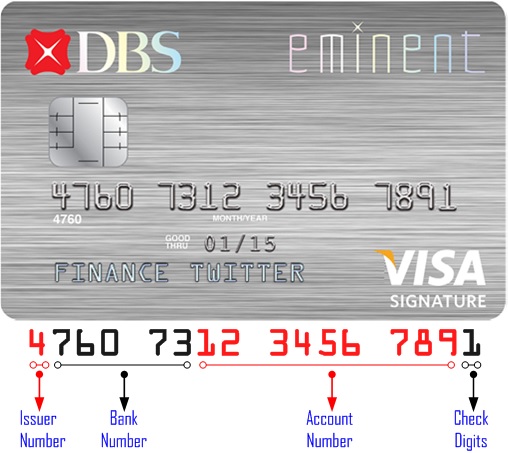

One’s credit score is actually obtained ranging from three hundred so you’re able to 850, having three hundred suprisingly low and you will 850 perfect. The latest median score, in which 1 / 2 of the fresh new borrowers has a lower rating and 50 % of enjoys a top that, is mostly about 720.

And Fannie and Freddie have increased fees getting individuals with down credit ratings as casing crisis worse – they have increased twice this year alone. The low the latest score, the higher the price.

Such as, Fannie charges a-1% up-front percentage (increased regarding 0.75% come july 1st) for consumers which have a credit scoring away from 680, even in the event they have been paying 20% upon their houses.

Even individuals with the very beneficial ratings, ranging from 720 and you can 740, shell out a little fee equivalent to an up-side charges out-of one fourth area. That is a difference regarding earlier in the day.

«You give those with 730 credit ratings paying 20% down that you have to fees all of them a-quarter point extra in addition they evaluate you adore you’re in love,» he said. That comes so you’re able to an additional $29 30 days to the a good $2 hundred,000 financing.

Individuals that have results lower than 600 might have to shell out a charge away from an entire payment section or more, incorporating $120 with the month-to-month can cost you of the mediocre mortgage.

People when you look at the mortgage-based bonds are simply demanding that they getting compensated the extra risk you to a borrower is short for, considering Jon Kaempfer, a loan manager which have Vitek Mortgage Group for the Sacramento, Calif.

Habetz had a consumer recently which have an excellent 735 credit score getting down 20% -an extremely good candidate -together with buyer still failed to qualify for a knowledgeable speed

Kaempfer had a customer with an excellent 635 credit score recently just who desired to do a funds-away refinancing, a deal where an existing citizen removes financing for over the borrowed funds is worth. This new homeowner becomes big money of money, and therefore it client planned to use to buy particular family developments.

The lending company planned to charge 1.5% of your financial principal up front simply because they it had been a cash-out bargain, also 2.5% alot more from the family customer’s more compact credit history. Those individuals costs, collapsed to the loan, extra on the a share point out the buyer’s interest.

«You have to be fantastic, keeps at least good 680 score otherwise a great 720 when you find yourself and then make a smaller deposit, to help you be eligible for the best rates,» said Kaempfer.

Gumbinger anticipates lending standards to remain tight towards the foreseeable future, for as long as home values continue to slide. The possibility of foreclosure was however a lot higher for the a beneficial falling sector, and you may loan providers have to protect by themselves.

When the and if cost create raise, states Gumbinger, consumers which have less than perfect credit results gets some breathing room.