Almost every other preferred topics

- Look for Make a fees

- Try to find Sign-up

- Check for Rates

- Choose Get Advantages

Extremely important Announcements

That is clear. A home is a big pick and a huge money. How much you’ll end up spending money on they through the years can be getting affected by many facts, even more apparent as opposed to others.

Since an arizona state first-day homebuyer, you may wonder towards different varieties of home loans readily available and you can which one you should choose. The good news is, there’s a lot of information to take on. If you get home financing, you are committing to pay for a primary buy that you know, therefore desire to be yes you are carrying it out best. Financial rates, terms and conditions and lender requirements ought to be studied into account.

Finding the best mortgage for your home buy doesn’t have so you’re able to become scary or exhausting. You could undergo the procedure easier with a little piece of studies. Some tips about what you have to know one of the popular well-known versions regarding lenders.

Traditional mortgage

A traditional financial is actually home financing that’s not considering otherwise covered of the a national institution. This is actually the «typical» home loan most people consider once they talk about purchasing good household, and is offered by most loan providers. Traditional financial rates were very equivalent across monetary establishments, however should contrast even offers of about about three lenders to discover the best speed.

Words on the traditional home loans can vary, however, 15- or 31-year conditions are definitely the most frequent. The real difference is that, because the property costs is actually spread over a longer time from date having a thirty-12 months home loan, this new payment per month is leaner than simply regarding good fifteen-season financing. However,, just like the you’re making money for a longer period, the pace are higher than it would be to own a fifteen-12 months mortgage. While some adjustable-speed options are readily available, repaired interest rates much more typical – definition the speed continues to be the exact same towards the lifetime of the fresh new loan.

When you can afford a top monthly payment, a shorter financing title can save you thousands of dollars during the desire and also your house paid down sooner. Deciding the best mortgage hinges on your individual financial points.

First-go out homeowners usually imagine they should promote 20% of cost given that a deposit to help you qualify for a loan, but that is not at all times the truth. Of numerous conventional loans appear that have as little as 5% down, so there try even funds that require no money down – though you are able to still have to think settlement costs. The no credit check loans in Maytown, AL biggest variation when putting off below 20% is you We).

Even when PMI can be paid off by homebuyer, its made to cover the lender, and is also the lending company one to decides the advanced and exactly how its paid. Certain loan providers charge much more for this than others, so shopping around would be smart to help you save well on their homeloan payment each month – and on extent you’ll spend across the life of the mortgage.

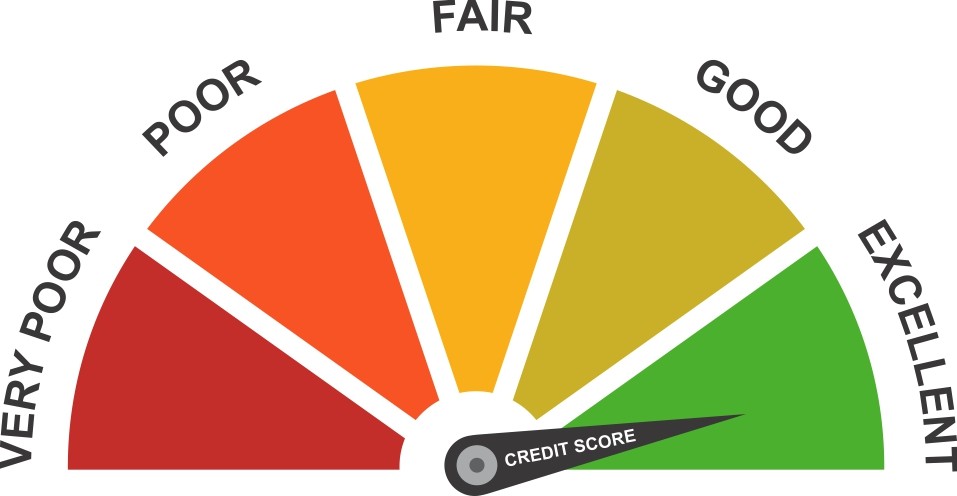

Home loan pricing aren’t the only procedure you will need to consider when deciding on home financing. A conventional financial can be good for homeowners which have a good credit score evaluations and you may a good debt-to-earnings (DTI) ratio (just how much you happen to be paying out per month in place of what kind of cash is on its way from inside the).

Once the an initial-big date homebuyer, you should ensure that your obligations load is really as reduced because fairly it is possible to so you do have more borrowing from the bank stamina for your financial. Paying off the handmade cards or an auto loan can also be raise the ratio, that will imply being qualified to possess a top-cost domestic.