As neighborhood means an age modern thinking with emphasis toward individual independence, alot more unmarried mothers are considering becoming property owners and you can luckily for us sufficient, it has become smoother than ever before to possess performing parents to shop for a property if or not these are generally a single mom otherwise a father. Predicated on a report by United nations, approximately cuatro.5% of all Indian households are run by solitary parents. One parent to find a house needs to be a lot more cautious due to the fact whole duty of the property to invest in processes (no matter which have assistance from friends), continues to be befalling a lone pair of shoulders.

Ensure you get your earnings managed

- A regular revenue stream where that loan are going to be offered and additionally a good credit score ratings.

- (Otherwise a constant organization/self-employment).

- Single moms and dads meet the requirements if how old they are during the time of approve try ranging from 18-70.

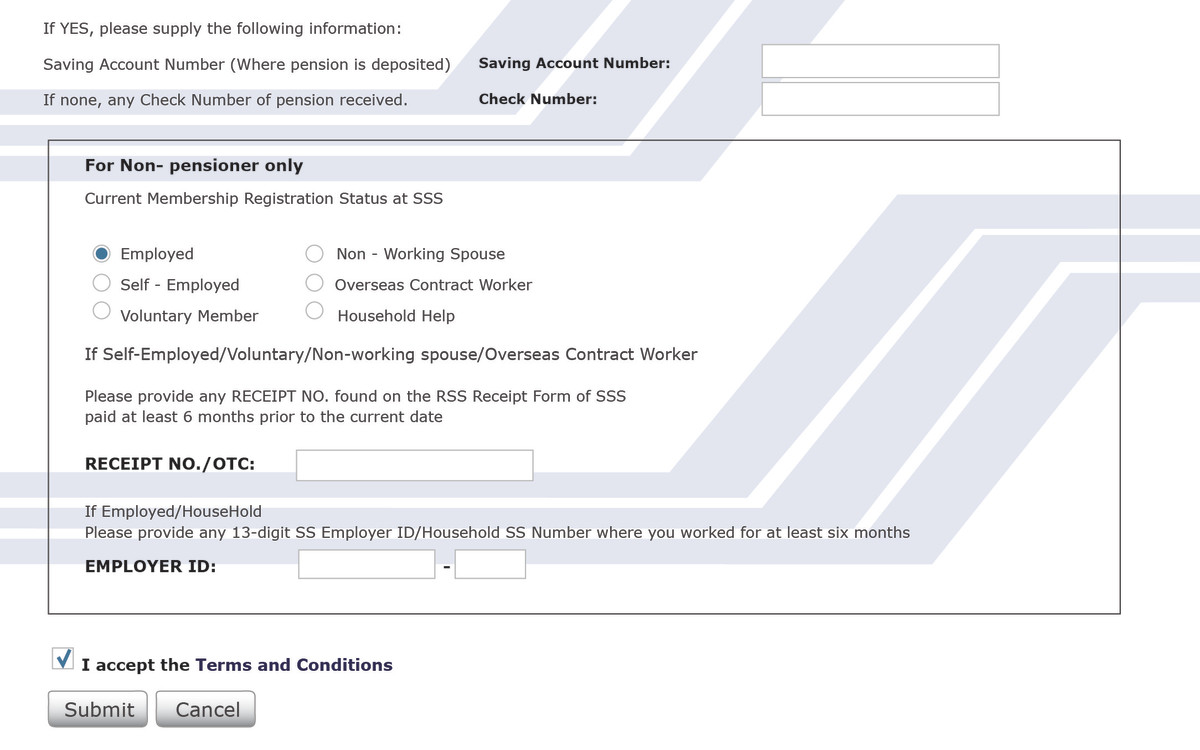

- Contain the expected data such as for example

- Bowl Cards, AADHAR Cards, accomplished loan application

- Govt approved ID proofs such license, voter ID, passport

- Home-based evidence such as for example fuel and you can tools costs, savings account statements, almost every other relevant records like beginning permits, etcetera.

- Report and you can proof individual possessions, collateral

Economic strategies for solitary moms and dads before you buy a house

Invest in a baby education bundle (which have top-notch asking) so that the newborns instructional benefits was secured also while in the possible volatile monetary standards. Make sure the insurance policy grows over ages in accordance with the number of people you’ve got.

Envision investing in protection and riches baskets monitored because of the gurus and you will choosing to give the assets in various SIPs/collateral funds. Whether your discounts was restricted, you can consider various other reasonable-give insurance policies as well.

Finding out the goals off what you need on the property

Because a dad, you might must alive where your child features the means to access a great schools, trains and buses, social locations, and other items predicated on your life style. You’d should also check out the apartment’s venue (and that floor, exactly how many rooms, restrooms, and other services that you might predict about casing communities eg a great garden center, gymnasium, share, golf courtyard, and others).

Most other things to consider would be the length from your home to school, especially when staying in metropolitan locations where in fact the commute try an effective grounds as well as the availability of instantaneous healthcare/centers around the home.

If you’re getting a home loan, it seems sensible to store the latest cost around 31% of the total income so that you can real time easily with the rest number and also save your self.

Pick a constant and you may inviting neighborhood

Whether you are widowed, divorced, or separated, might have to encircle oneself with an assistance program not only has family and friends, also residents and community. Given that adage happens, it requires a village to improve an effective child’. Brand new casing neighborhood the place you plan to alive should have supporting and expertise neighbors. If a society enjoys a cure for stop protection and you will area government software such as for example MyGate, it is good news getting solitary moms and dads whilst works on good passcode verification system away from gatekeeping so the premises are completely as well as youngster security process, in which a baby is not permitted to get-off brand new premise unaccompanied in place of past consent on mother.

Really does our home have a great resale really worth?

As an individual parent, avoid being stressed to order a home instead the next possible while it may come cheap. You need to factor in the marketplace value of the property, the location, their size, distance to social utilities, shopping malls, an such like, and possess a specialist assessment done in circumstances you are not to find a domestic.

See features and you may helps

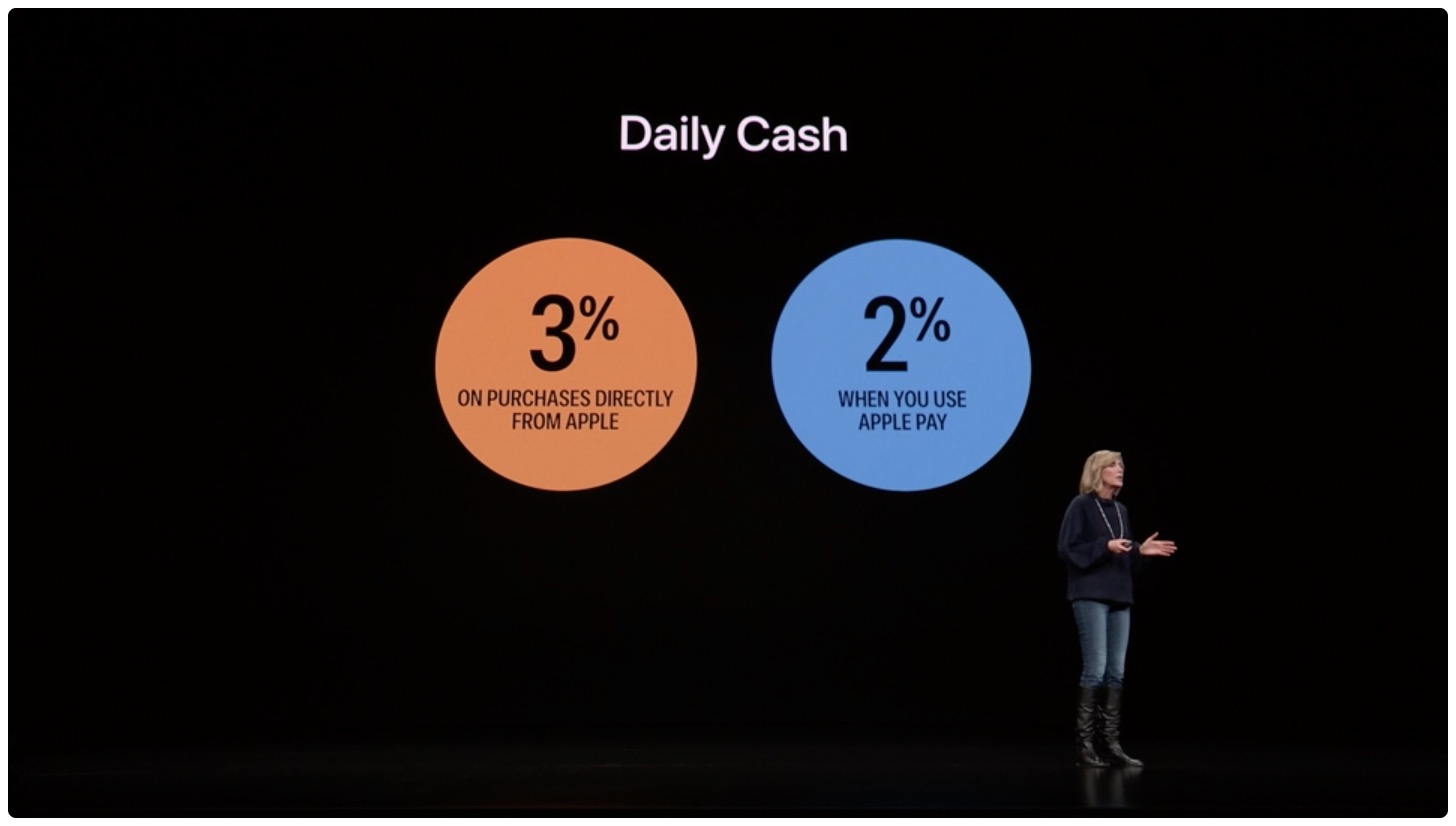

Due to the fact one mother, you could potentially avail some great benefits of reasonable-rates into the lenders off nationalised banking institutions such as SBI and someone else. Specific claims p obligations and you may membership costs, sales deeds, conveyance deeds if for example the buyer was a female. Beneath the Pradhan Mantri Awas Yojana, if you’re a (single mother included) household with a yearly money anywhere between Rs six lakh and Rs several lakh fall under MIG (middle class communities) I when you are home having a yearly money ranging from Rs a dozen lakh and you may Rs 18 lakh fall into MIG II group and that you might be entitled to notice subsidies regarding 4% and 3% to your loan amount to Rs 9 lakh and you can Rs 12 lakh (MIG I and MIG II groups just). Facts.

It is recommended that since the one parent as opposed installment loans in Hawai to past feel during the possessions buy, you really need to hire a reputable estate agent who’ll make it easier to navigate through the process that have professional guidance.