Smith Economic founder and you will leader Stephen Smith said the mixture of these two loan providers is actually described as an effective cultural fit and you will subservient advantages. Photo by Peter J. Thompson/Economic Post

Content articles

Smith Monetary Corp. try consolidating a pair of the portfolio people in a shift they says will generate a respected option bank within the Canada.

Smith Financial agreements beefed-up solution financial which have Domestic Trust-Fairstone Lender merger Back again to video clips

The fresh new advised blend of Fairstone Lender of Canada, and that focuses primarily on individual fund, that have financial-concentrated Home Trust Coes immediately after Smith Financial closed their purchase of the latter last year.

- Personal stuff regarding Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.

- Every day articles out-of Economic Times, the new planet’s top internationally business book.

- Unlimited on the web entry to discover stuff of Financial Post, Federal Post and you can fifteen reports sites across the Canada with you to account.

- Federal Post ePaper, an electronic imitation of your own print model to view for the people device, show and you may touch upon.

- Exclusive posts out-of Barbara Shecter, Joe O’Connor, Gabriel Friedman while some.

- Every day content from Monetary Times, brand new planet’s leading around the globe organization book.

- Limitless on the web entry to realize articles away from Economic Article, Federal Article and you can 15 news websites across the Canada having that membership.

- Federal Blog post ePaper, an electronic imitation of print release to get into with the any unit, display and you can discuss.

Sign in otherwise Carry out a merchant account

The mixture do create a more powerful money base and have now carry out synergies when you look at the section such as chance administration and deals, told you Smith Monetary inventor and you may chief executive Stephen Smith.

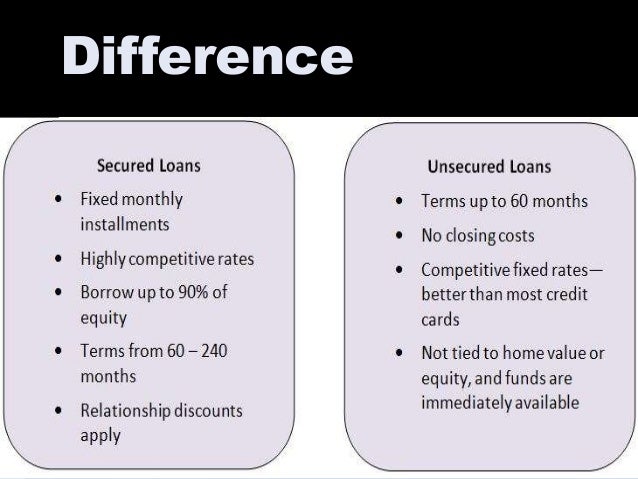

Fairstone Bank also offers handmade cards and you may advantages software, point-of-profit capital, automobile financing and private funds, while House Believe is approximately residential and low-home-based mortgages, handmade cards and you can guaranteed financing permits.

The alternative loan providers commonly serve customers exactly who find it very difficult so you’re able to secure finance of more traditional present particularly financial institutions, whether it is on account of a dismal credit rating, faster foreseeable money, or these are generally newbies to Canada.

In deal, Smith Economic commonly very own a big part risk in the the fresh new business, if you are Fairstone Bank’s almost every other investors – Centerbridge People LP, Ontario Teachers’ Type of pension Panel and you can government – continues since the minority citizens.

The combined entity would probably keep both the new Fairstone otherwise Home Trust identity, but it’s not yet decided, said Smith.

Increased filters

The deal appear since consumers are showing improved filters off large interest levels, but professionals in the one another Fairstone and Domestic Faith characterize it more of a great normalization away from borrowing that have nevertheless strong payments.

We see a highly, quite strong commitment to pay-off financial obligation of the Canadians, said Yousry Bissada, president and chief executive away from Family Trust.

He asserted that while some will be forced to sell, consumers mainly have sufficient guarantee in their house to provide a great shield.

Very even though they was inside the arrears, there are many chance of them to promote and just have away of it in the place of penalty on it or even us.

The lenders said they’re also viewing highest consult because banks tighten upwards their borrowing standards, and are usually not expecting subsequent destruction inside the delinquency profile https://paydayloansalaska.net/port-alsworth/.

The fresh new proposed merger plus comes as the national try swinging to lower the maximum enjoy interest to help you thirty five percent to your an annualized payment speed basis, off from 47 percent.

Fairstone is totally happy to meet with the government’s policy cap, that have less than 15 percent regarding Fairstone’s funds above the thirty five % rates, told you their leader Scott Timber.

Smith said the guy will not predict government entities to lower the rates then, and that the guy thinks it knows that the eye costs charged mirror the risk inside.

Just what our company is concerned about the following half dozen to help you 9 weeks try to place the firms to each other … and gives far more activities to help you Canadians all around the country.