Present money are allowed of all fund if they are from a reasonable resource including a grandfather, companion, brother, grandparent, and a few anybody else

Whenever i inquire a candidate if they have an advance payment, I know already the clear answer. Was We a mind reader? Sure! Um okay … in reality, no. But i have been performing this long enough which i have obtained towards the social signs such as for instance body gestures, dead air, and the mutual significant appears anywhere between spouses or even the anyone We am meeting with one to hint myself into the about what they are attending state. Fundamentally, I have one of two solutions: An instant and you may satisfied, Yes, we can lay out (enter fee otherwise money count right here). Or, We stumble on an embarrassing quiet for most mere seconds followed by the customer advising me personally he’s got almost no conserved otherwise were dreaming about a loan that does not wanted hardly any money off.

There is nothing completely wrong to your next reaction. We hear they usually and it doesn’t promote the applying so you can a good screeching stop instance the majority of people concern. It’s simply one more piece of their situation that i sort out to discover the best loan choice to match its needs. All the consumer’s condition differs. Not every person enjoys a down payment when they’re ready to purchase a house. Does which means that cannot? In my opinion, not always. I would suggest consider the choices to see if the cost of wishing and you may protecting outweighs the expense of to shop for today.

While you are pursuing the housing market, brand new commonplace forecasts state we will face an increase in rates and home prices throughout every season. That it merely follows legislation away from have and you can demand. Discover not enough property on the market together with request are high, so that the costs increases. Pricing try a small much harder to help you expect, but there is however certain hope they stand constant and never rise, instance we are hearing they are going to for more than annually.

Simply speaking: Consider your options and do what is actually good for you. Should you need it, but don’t has a downpayment yet, here are a few this advice getting creating an advance payment:

Check into advance payment advice solutions you are able to be eligible for. In Cache Valley, to own first time homebuyers, there are solutions for instance the Own from inside the Logan Grant from Neighborhood Non-Earnings Casing therefore the Sustain Lake Organization regarding Regulators which gives Brag Finance, a no curious deferred financing.

Some individuals choose use otherwise withdraw off their 401k. Mothers may even present money on their students off their own account.

You will find homeownership financing programs available to choose from, which help which have a deposit in return for a share for the future change in worth on your household.

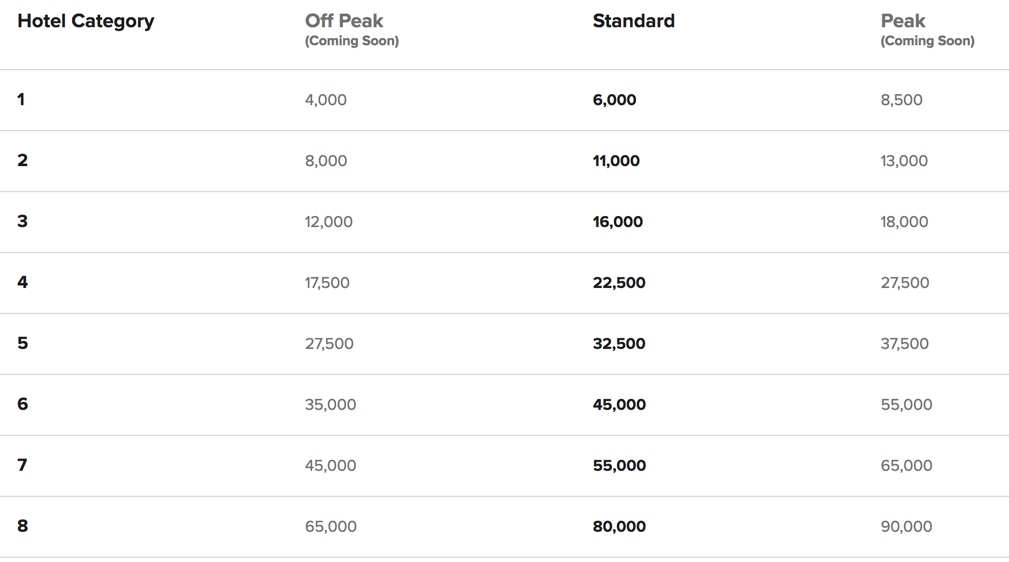

Loan software have changed typically. A loans Haswell high down-payment is required in for the last to even rating financing. That is not the situation more. There are other mortgage available options than before, even though you haven’t spared a substantial deposit:

When you’re trying to buy from inside the an outlying area, thought an effective USDA Financing. This program doesn’t need a down-payment, however, features particular restrictions.

Utah Housing was financing system that gives financial support on variety of an initial and quick second mortgage to fund 100% financial support, for those who meet the requirements.

Having experts otherwise a thriving spouse of a veteran, you have the Va Mortgage program. It will not want a downpayment.

Very loan providers commonly believe you to definitely become a reduced amount of a threat with a good downpayment sum on the financing. This might imply a lesser rate of interest minimizing or no mortgage insurance coverage (all the way down initial costs minimizing ongoing costs), meaning that a lowered payment. You will also have significantly more collateral right off the fresh batbined with a credit rating, you ought to expect you’ll feel a smoother financing and you can a shorter loan control timeframe.

You can find homebuyer groups available online that assist you due to all you have to learn about to purchase a house. Talking about an effective starting point before interviewing a beneficial financial.

Possibly even check up on a dedicated coupons or an IDA Savings Membership system that fits the cash you put involved with it

Still, my personal best advice would be to get a hold of a bank, one who tries to know your unique condition and will be offering you with all available options for you. They should and help you know all you has questions regarding. Don’t let yourself be frightened to inquire about concerns. You aren’t that loan, you are a consumer making one of the most crucial requests you will ever have. Your financial is always to take time to be your guide thanks to the entire processes that assist you will be making an educated decision.