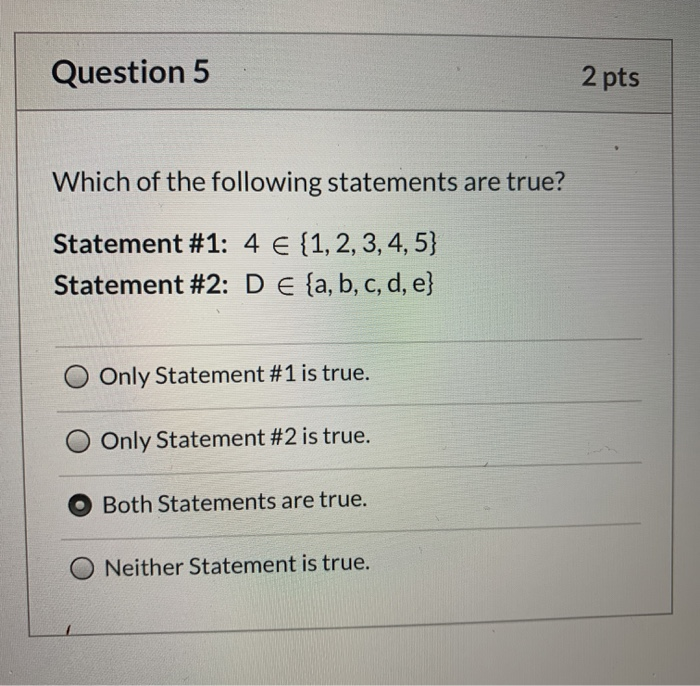

Financing words

Instance, an effective $100,000 domestic guarantee loan that have a great 10-year name might have a monthly payment out of $step 1,060, if you’re a good $100,000 house guarantee mortgage with a 30-season name will have a payment per month out-of $430.

If you are considering property guarantee loan, it’s important to reason for the latest faster financing term when budgeting for the monthly installments. It’s adviseable to make sure that you provides a plan to possess paying your loan until the stop of your own loan name. If you default on your own financing, you could potentially get rid of your residence so you can foreclosures.

- Ensure that you can afford the monthly obligations.

- Has plans to possess settling the loan before the avoid of your financing identity.

- Consider delivering property security personal line of credit https://clickcashadvance.com/installment-loans-wa/ (HELOC) unlike a house equity financing. HELOCs has actually varying rates and permit you to borrow cash since you need it, which will make them more versatile and reasonable than family security finance.

House security finance are a useful treatment for access bucks, but it is crucial that you be aware of the threats involved. Smaller mortgage conditions are among the most significant threats for the family guarantee loans. By the knowing the dangers and you may bringing strategies to mitigate them, you could potentially assist make sure your family equity loan try good success.

Domestic guarantee funds would be a great way to availableness cash, but it is vital that you understand charge inside it. Such charge adds up, therefore it is important to foundation them to your finances in terms of a home equity mortgage.

Closing costs is the charges that you spend to shut your own mortgage. Sigue leyendo