Experienced home owners are usually the target off dishonorable mortgage companies seeking when planning on taking advantageous asset of individuals who offered our very own nation. Based on a buyers Financial Safeguards Bureau’s Virtual assistant “Caution Purchase,” certain predatory loan providers want to select experts that have refinancing income one to exit all of them bad from. If you find yourself these offers tend to arrive official, they boost loan terms that will be very tempting to property owners. Check out telltale signs your Va Home loan Re-finance try a fraud to ensure people are going to be conscious of they and get away from dropping victim to unethical lenders. Sigue leyendo

Archivos de la categoría if cash advance

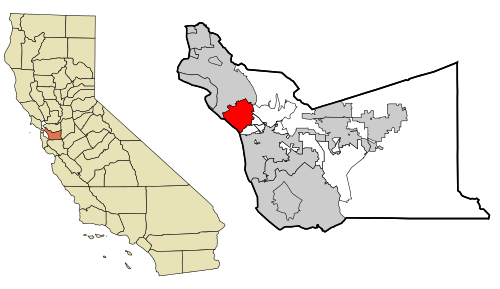

City of El Paso First-time Homeowners System

If for loans Anniston AL example the think of to get a homeowner into the El Paso seems hopeless, learn you are not alone. Once the market have yes knowledgeable their ups and you will lows in recent times, there are an effective way to reach your ambitions. One such way is by making use of down-payment recommendations programs . While the an Este Paso lending company , Rocky Mountain Mortgage lender helps you discover the perfect down payment assistance system to help relieve new monetary weight from owning a home.

Need assistance having property advance payment from inside the El Paso? (915) 593-3111 to talk to one of our financial experts!

Because identity ways, downpayment assistance applications are specially made to let people who require help with the future house’s deposit. A down payment is frequently 10% to 20% of one’s house’s price. What if you will be looking to buy property one to can cost you $400,000. The latest deposit is any where from $forty,000-$80,000. That have a down-payment recommendations program, you’ll get let towards make payment on down payment. Sigue leyendo

Advantages and disadvantages off Pennsylvania Household Collateral Funds

Discuss the likelihood of with your home’s equity to attain the financial objectives. Inside the Pennsylvania, look for designed house security mortgage choices with competitive pricing and professional guidance. You can expect aggressive household security loan cost in Pittsburgh or any other locations during the Pennsylvania. Reach out today to see how you could safer a good home collateral loan rate inside the Pennsylvania.

What’s a home Collateral Mortgage?

Property collateral loan , usually termed another mortgage, allows homeowners so you check this link right here now can borrow on brand new gathered security inside their property. Collateral is the difference involving the current market value of the fresh new family and you will people outstanding financial balances.

To track down property guarantee financing , you really need to submit an application for the borrowed funds because of a lender, who evaluates the new offered collateral at home centered on their introduce well worth and current mortgage costs. Just after acknowledged, you receive the borrowed funds matter as the a lump sum, and that’s useful for some purposes such family renovations or combining obligations. Repayment takes place over a fixed title, which have monthly installments layer each other prominent and appeal. Even after generally giving all the way down rates of interest on account of being secured by the house, you need to be attentive to the possibility of foreclosures in the event that you don’t see repayment debt. Sigue leyendo

What are the Positives and negatives regarding Family Equity Funds?

Acknowledge new built-in dangers with it, and you can a home worthy of activity are latently unwrapped by the leverage a household once the security. Good downturn actually leaves home owners owing over the homes’ depreciated really worth.

Going for a property security financing sells effects to possess upcoming freedom. Moving projects try affected should your home profit fails to recover the fresh a great mortgage balance, resulting in financial loss or hindering relocation preparations. Exercise prudence and avoid dropping back again to the latest period regarding racking up high-attract debt should your financing is intended to alleviate mastercard loans. View every options available and weigh new relevant risks up against possible pros prior to committing to an application one encumbers the home. Sigue leyendo