Creating good credit requires discipline and patience

Strengthening good credit from the ground upwards takes discipline and patience. It will not happens right away, but you can carry out acts in order to automate the process and you may ensure that your rating does not slip in the procedure.

How long Will it Sample Obtain a good Credit history?

To build a credit rating out of scratch, you need to make use of borrowing from the bank, like by starting and using a credit card or expenses back a loan. It will take regarding the six months out-of borrowing hobby to establish enough record getting a good FICO credit history, which is used during the ninety% from credit behavior. FICO fico scores are priced between 300 so you can 850, and you will a rating of over 700 is recognized as an effective borrowing rating. Score over 800 are considered higher level.

Never expect a magnificent number right from the start. Although you is also develop enough credit rating in annually generate a rating, it takes several years of wise borrowing use to get a better or excellent credit rating.

VantageScore, another credit rating, would be made sooner than their Credit ratings. Your own FICO credit score is just one to watch over the long term. But not, to ensure that you are on the proper track whenever carrying out, your own VantageScore can indicate how your own methods think about your brand-new credit score.

Why does They Take the time to Generate Advanced level Borrowing from the bank?

Whenever you are starting to generate a credit rating, big date can not work to your benefit. Lenders like to see good conclusion throughout the years, that’s the majority of just what Fico scores take into account:

- Payment background (35% from score): Maybe you have produced with the-day costs continuously?

- Amounts owed (30% out of score): Simply how much loans do you have than the how much readily available credit you really have?

- Length of credit score (15% away from rating): Typically, just how long get profile become discover?

- The brand new credit (10% of rating): Maybe you have launched several the fresh borrowing from the bank accounts when you look at the a preliminary amount of your energy?

- Borrowing from the bank blend (10% out of score): Are you experiencing sense dealing with different kinds of credit and you can loan?

Proof which you build costs timely and do not hold high balances installment loans Birmingham AL on the handmade cards allows you to a shorter high-risk, alot more trustworthy borrowing from the bank user from the eyes out-of loan providers. The individuals in charge habits hold more excess weight whenever presented throughout the years, too, for this reason , strengthening good credit out of scrape doesn’t happens right-away.

The direction to go Strengthening good credit

Unfortuitously, the fresh new challenging area about building a credit score gets the newest borrowing you need to would a credit score to own a score. Fortunately, you will find several ways to initiate creating a credit score and you can a great rating.

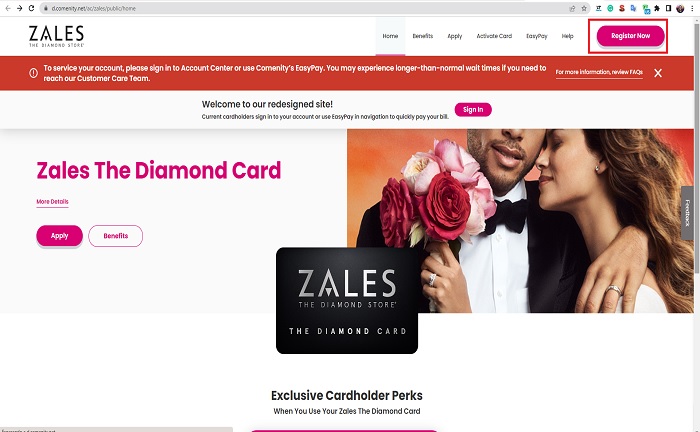

Unlock a protected Credit card Membership

You can unlock a protected cards when you aren’t eligible for most other cards since this types of bank card demands in initial deposit. This new put will act as guarantee on the issuer for many who end and make repayments, therefore it is safer so they are able approve your. Secure credit places is refundable. Of many issuers tend to up-date you to a keen unsecured credit on demand after you have displayed you could intelligently carry out the latest card.

Credit card issuers declaration card balance and you may percentage background into credit bureaus typically all of the a month. Thus, it’s not hard to make a credit history which have a charge card because those individuals facts features huge has an effect on on FICO credit scores. Each month you make an on-big date charge card payment and don’t hold an equilibrium in your protected credit, your credit score will be rise.