Cash-Back Rewards

That have SoFi’s Examining and you will Bank account, you can earn doing fifteen% cash return during the regional resellers when you shell out with your debit credit. From that point, your activate gives you must search for, interact together with your SoFi debit cards, and make money straight back.

Only note that you have to swipe your own card and you will work at it as a cards deal to make cash back. Along with remember that money back pricing try susceptible to change, and lots of even offers pay 1-2% money back, perhaps not fifteen% every time.

Sign-Right up Incentive

During creating, you can make up to $300 to have opening yet another SoFi Checking and Savings account whenever you get qualifying head put wide variety. Discover about three prize levels:

Getting up to $three hundred for beginning a monitoring and you will family savings is considered the most the greater offers you can find off cellular banking companies and brokers. And you’ve got 25 months for being qualified head dumps so you can fulfill added bonus criteria.

Easy Deposits & Automatic teller machine Distributions

One downside of some on the internet financial institutions otherwise bucks management levels is which they usually do not deal with bucks otherwise examine dumps. It isn’t really an effective dealbreaker, but it is nice to obtain the flexibility to pay for your bank account however you like.

Having SoFi Checking and you can Savings, you could withdraw cash commission-without 55,000+ AllPoint ATMs. You may want to head to stores that have GreenDot services and then make bucks places having a great $cuatro.95 commission.

Was SoFi Checking & Coupons Safer?

The SoFi Examining and you will Bank account stands up so you can $250,000 in the FDIC insurance policies. It is inside-line together with other mobile banking institutions, plus it means your hard earned money is secure in your membership. Features like one or two-grounds verification and research encoding and help protect your bank account and you can private information.

What Else Really does SoFi Promote?

One advantageous asset of beginning an effective SoFi Examining and Savings account was you will get to become listed on brand new SoFi environment. Including a variety of paying, banking, and you may loan characteristics you could potentially make use of, including:

- SoFi Automatic Spending

- SoFi Productive Using

- Student loan refinancing

- Home improvement money

- Mortgages and you will refinancing

- Tenants and you can homeowners insurance

- A beneficial SoFi award mastercard

SoFi professionals also can developed a trip with a monetary planner, fee-totally free, to discuss private loans and you may investing pointers. This will be several other book https://paydayloansconnecticut.com/northford/ selling point for everyone of SoFi’s situations, and it may save you money rather than purchasing information regarding another financial coordinator.

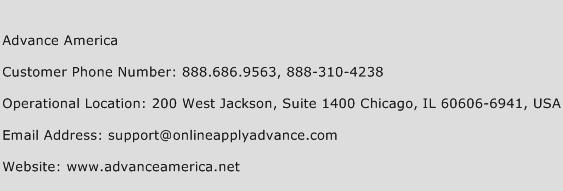

How to Contact SoFi?

You could get in touch with SoFi that with the 24/eight support service widget toward the website or cellular application. Checking and you can Deals assistance is even readily available by cellular phone at the 855-456-7634. Mobile phone assistance can be acquired Saturday courtesy Thursday from 5 in the morning so you’re able to 7 pm PT and you will Monday owing to Sunday off 5 in the morning so you’re able to 5 pm PT.

Finest Solutions

If you would like a flexible checking account you to pays a competitive interest and money-straight back rewards, SoFi Examining and you may Coupons is a superb solutions.

But not, the latest head deposit requirements to earn the utmost interest you’ll be a deal-breaker for most. At the same time, there are lots of other SoFi choices with higher level checking, offers, and you can hybrid levels.

Ally is one of the most powerful solutions, therefore features a direct expenses ( Ally Dedicate ) and robo-mentor option including SoFi. Plus, you can open a premier-produce bank account and money business membership with really aggressive cost.

Chime is another higher level solution, and it also now offers possess the same as SoFi including early paychecks step three , no-fee overdraft coverage 5 , and also cash advances.

Finally, CIT enjoys many sophisticated offers and you will examining account, a financing field account, and you will repaired-money items like Dvds as possible discuss.