It’s really no magic that many Us americans try burdened by financial obligation. Since the first one-fourth from the 12 months, household personal debt enhanced of the $148 billion so you’re able to $ trillion, depending on the Federal Set-aside Lender of the latest York. As a whole, non-construction balance became by the $24 mil. When you are one particular battling and are usually searching for ways to efficiently control your personal debt, that can indicate using a home security loan to combine it.

Combining the debt that have a property guarantee mortgage can make it far more manageable, if you find yourself potentially decreasing the appeal you’re purchasing inside. If you have produced enough payments on your own mortgage which you have built upwards a substantial chunk out of collateral, this package is worth given. We are going to help you look closer.

Must i combine my financial obligation having a house guarantee financing?

A house collateral financing is actually the next financial, which enables property owners to help you borrow funds making use of the security in their property due to the fact collateral. Household guarantee loans are often used to consolidate your debt, whether or not which is personal credit card debt or car loan financial obligation. Due to the fact there’s already accurate documentation quantity of family equity, Costs Banfield, manager vice president of funding locations on Skyrocket Mortgage, claims one to property owners with personal debt or would like to make renovations can be consider this to be solution-therefore most relates to the newest math.

Meaning knowing your interest on the current financial and you will knowledge exacltly what the combined rate could well be. Their blended rate, Banfield says, is your very first lien together with your second lien, if you choose to do this. You might then compare you to on the interest rate towards the any sort of obligations you’ve got. Then you may bother making a choice out-of Can it create more sense accomplish property collateral loan, otherwise will it make significantly more sense reliant just what [you’re] trying accomplish to help you roll it all for the one to new basic lien financial? Banfield states.

He went on: You may have security on possessions, and you are only planning to do so whether or not it places you in the a much better updates. Which is to relieve debt obligations, perhaps not enable it to be bad.

Making use of a home equity financing in order to combine the debt

Second mortgages tend to want large borrowing from the bank, thus to be eligible for a house equity financing, you have to illustrate that you be able to pay back the mortgage. However, complete the process for finding a property security mortgage was effortless. You have got to start with contacting a loan provider you to also provides second mortgages. Following that it is possible to make an application for you to home guarantee loan and bank will opinion the job (your revenue and you will credit score, particularly) and carry out an assessment on your own home. The capability to demonstrate that it is possible to pay back new financing is key, Banfield claims.

It starts with earnings, Banfield contributes. Do you have a steady income source that people normally document to display the capacity to pay back your entire expenses? Number two was credit history; typically you are going to look for 2nd mortgage loans try 680 Fico scores otherwise large…and you need to enjoys guarantee throughout the possessions you very own.

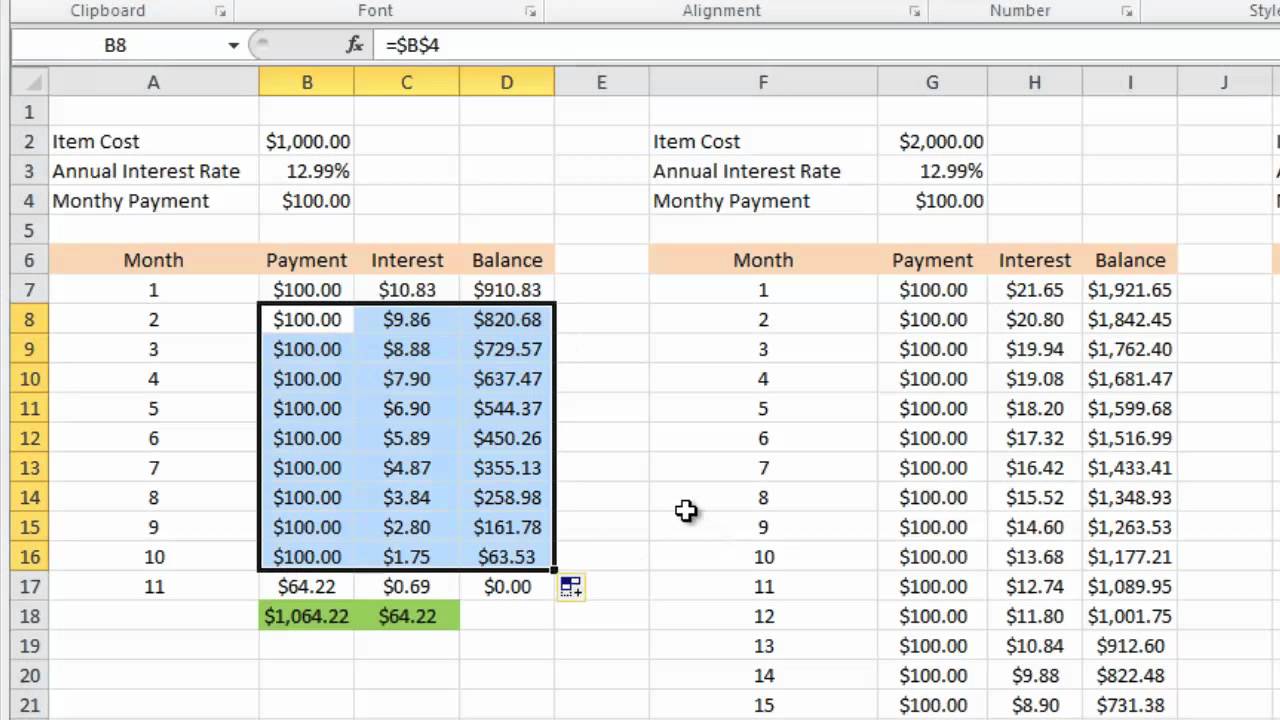

Regarding debt consolidation, generally the lender takes a look at all your debt-whether one to getting personal credit card debt, student education loans, car and truck loans-you are trying to plan as a whole and you can combine to your an effective solitary commission. When it was $50,000 worth of personal debt, they’d break it down and you can spend those people enterprises.

Which means you no more will have to build costs there, you as an alternative would-be while making payments in your brand new next financial, Banfield claims. And just like your first mortgage, you would be to make normal and repeating money.

Pros and cons out of consolidating financial obligation that have emergency cash for single mothers a home collateral loan

Merging personal debt having a home equity mortgage is often at the mercy of personal factors, Banfield claims. But because the Federal Put aside possess elevated interest rates aggressively, charge card cost have gone up and are hovering simply around 20% and you can more than based your credit score, such as for example.

If you may a home collateral mortgage throughout the 9% in order to 10% variety, it may be a content deals to you personally to your desire, and you will you would have the ability to pay you to definitely for the that loan which is fully amortizing more than an effective 20-season several months, Banfield states, adding that is about just what Skyrocket Mortgage also offers. This will provide you with handle, such as for example you have consolidated it, you’ve gotten out of the poor credit card obligations. You still have the debt, however, you are in a structured unit that is going to assist you to expend it down.

Yet not, that is not to state that it is all a. What if your consolidate your entire credit card debt, but then start racking it up once more-that place you from inside the an even worse budget. Generally there are risk, but a good amount of it has to perform with your choices.

- Interest rates on domestic security loans are typically below borrowing from the bank cards, therefore you will probably keeps less monthly payment.

- Household equity loans keeps fixed rates of interest, and therefore they won’t change if pricing rise, therefore you have a routine and foreseeable commission.

- You should have one fee, instead of multiple repayments, to bother with.

- You reside put once the equity, which means that you’re at risk of dropping your house when you’re not while making repayments.

- Family equity money has actually fixed interest rates, which means they will not transform if pricing go lower.

- House security loans have a tendency to incorporate settlement costs and you may costs.

Alternative choices to pay your debt

A home equity financing isn’t their sole option for those who ple, discover unsecured loans that allow you to borrow cash out-of a bank or credit commitment to make typical repayments. For example domestic security money, signature loans has fixed interest levels. But unlike family collateral funds, unsecured loans commonly supported by equity.

Transfers of balance are also an alternative. They might be a form of credit card transaction the place you disperse a great financial obligation from a single credit card to some other, generally speaking at a lower life expectancy rate of interest. As with any mastercard, just be paying about minimal harmony and you will carrying out such like date.

There are even personal debt payment/management preparations that you can thought; speaking of build and you may managed by the borrowing from the bank counseling companies, that offer down interest levels and want a monthly payment.

The fresh new takeaway

When you yourself have security in the possessions you own, a stable earnings, and good credit-but are in financial trouble, think combining your debt with a house collateral loan. If you find yourself financially in charge, this action makes it possible for that swelling your entire debt together into the you to definitely manageable payment, almost certainly with less interest. Start with conversing with a lender to find out if having fun with a great family guarantee loan so you’re able to consolidate your debt ‘s the right match to you.

You get the benefit of a lower life expectancy price because it’s secure your house, Banfield says. Just in case you can put your self within the a material greatest updates, and you are self-disciplined, and you are perhaps not gonna just go and replenish your own credit cards once more, the second financial would-be an amazing choice.