Play with the financial calculator founded directly into they! Rating appropriate rates to suit your monthly home loan repayments for a moment be asked to features individual mortgage insurance coverage (PMI). Along with discover why

svg]:rotate-180″ data-radix-collection-item=””>

Whenever deciding simply how much house you can afford, one of the most extremely important parts to determine is if an excellent household usually match your monthly budget. A mortgage calculator helps you comprehend the month-to-month cost of a domestic. And you can ours assists you to enter additional off payments and you may interest rates to assist determine what is actually sensible for you.

Lenders regulate how far you really can afford into a monthly construction percentage by figuring the debt-to-income ratio (DTI). The most DTI you can have to be eligible for most mortgage loans is normally between forty-five-50%, with your expected property costs incorporated.

Your own DTI ‘s the balance amongst the income plus obligations. It will help loan providers know the way safer otherwise high-risk it is to have them to approve your loan. A great DTI proportion signifies simply how much of terrible month-to-month money was spoken getting because of the loan providers, as well as how much of it is left for you given that throw away income. Its mostly authored because a portion. Eg, for those who pay 1 / 2 of the monthly income in financial trouble payments, you might have a beneficial DTI away from fifty%.

Just how to estimate monthly mortgage payments ?

The monthly mortgage repayment boasts financing prominent and you can appeal, property fees, home insurance, and home loan insurance (PMI), if the relevant. Without normally utilized in their mortgage payment, property owners in addition to pay month-to-month resources and sometimes spend homeowners organization (HOA) fees, therefore it is a good idea to foundation such into your month-to-month funds. It financial calculator circumstances throughout these types of regular month-to-month will cost you so you can most crisis new wide variety.

Algorithm to have figuring month-to-month home loan repayments

The simplest way to assess your own mortgage payment is to use a calculator, but for the fresh curious otherwise statistically inclined, here’s the algorithm getting figuring prominent and you can attention your self:

roentgen ‘s the monthly rate of interest(annual interest separated by a dozen and you will expressed while the an excellent ple:in case your annual interest was 5%, the latest monthly rates might possibly be 0. = .00417, or .417%

It algorithm takes on a predetermined-speed home loan, where in actuality the interest rate remains lingering throughout the mortgage name. And remember, you’ll be able to still have to add on fees, insurance, resources, and you can HOA fees if appropriate.

Strategies for which mortgage calculator?

Mess around with assorted home prices, locations, down costs, interest levels, and you can title loan Iowa financial lengths to see the way they perception the month-to-month home loan costs.

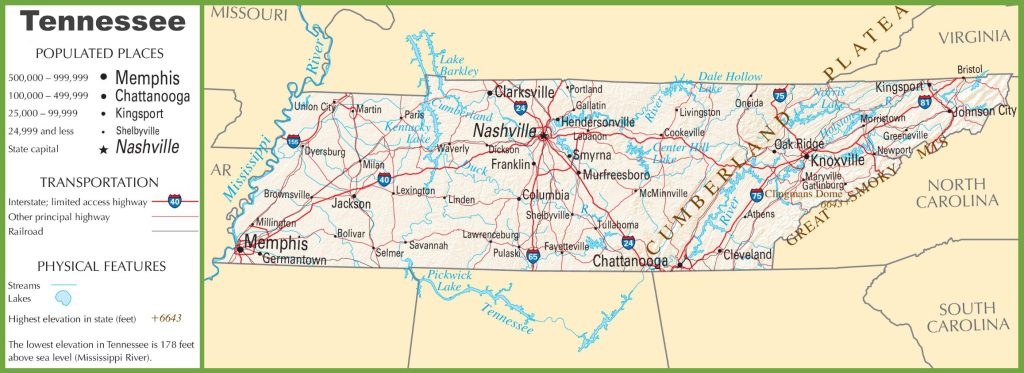

Increasing your deposit and you may coming down your interest rate and mortgage title length makes your monthly payment go-down. Taxes, insurance rates, and you can HOA costs vary by the place. For many who go into a downpayment matter that’s less than 20% of the property price, individual home loan insurance rates (PMI) costs will be placed into the month-to-month mortgage repayment. Because the costs of tools may differ regarding state to help you state, we now have included an effective tools estimate that you can break apart from the services. While you are thinking about to acquire a flat or towards the a residential district which have a property owners Relationship (HOA), contain HOA charge.

The only numbers i haven’t included will be the money you may need to save for annual household repair/fixes or perhaps the costs off home improvements. Observe just how much house you can afford and this type of will cost you, read the Ideal home value calculator.

Fun truth: Property tax prices are very nearby, thus a few belongings out-of more or less an equivalent dimensions and you can high quality towards both sides out-of a civil edging have different tax costs. To shop for when you look at the a place which have a reduced possessions taxation rate get allow easier for you to afford increased-priced household.