While the 1934, the brand new Government Construction Administration (FHA), that’s part of the latest Institution from Property and Metropolitan Innovation (HUD), might have been enabling somebody reach the think of homeownership. Through providing financial insurance rates one to covers lenders regarding default, having less strict certification, and you will helping which have down payments and you may settlement costs, the fresh new FHA could have been in a position to let hundreds of thousands secure construction as a consequence of accepted lenders like us.

Starting on , Brand new Government Homes Government (FHA) launched it is providing DACA Men and women to be eligible for FHA Mortgages.

DACA some body, labeled as dreamers, are those who happen to be undocumented however, was basically put to the U.S. before the 16th birthday and you can were underneath the period of 29 if group is made in 2012. Area Finance is actually excited becoming an integral part of this milestone in the business and we also desire toward permitting due to the fact we while we normally.

They were before getting refused due to verbiage on FHA Housing guide one said, Non-Us citizens without lawful home about You.S. aren’t entitled to FHA-insured mortgages. The definition of legal property pre-dates DACA which means that didn’t enjoy a position in which a debtor might not have joined the country lawfully, but nonetheless qualify lawfully introduce. Moving forward, here really should not be any facts with regards to legitimate residence to own DACA consumers seeking secure financing.

Why does an enthusiastic FHA Financing Functions?

When the an FHA Borrower defaults otherwise doesn’t pay-off the borrowed funds, the newest FHA commonly refund the lender toward leftover prominent to your the house. That it verify allows lenders to offer tempting home loan terms to people that are seeking safer investment that have a small down-payment otherwise mediocre credit rating.

Besides this unique element, this new FHA mortgage processes is the identical to some other home loan. Might apply and also pre-recognized, select a home, offered every necessary information and documents toward bank, do the latest checks, and you may indication the closing documents.

Advantages of FHA Home loan Apps

Typically the most popular cause to help you safe investment that have a keen FHA home loan ‘s the low down percentage requirementpared so you can a normal mortgage that requires a good 20% down-payment, FHA mortgage loans simply need a minimum down payment away from 3.5%! It opens up the fresh doorways of homeownership to a lot of ones whom is reluctant to fatigue its savings having an advance payment.

When you find yourself dealing with numerous debt, including figuratively speaking, don’t be concerned you can nonetheless safe investment which have an enthusiastic FHA Mortgage. That have FHA applications, your credit score normally determine the minimum down payment amount, it will never be greater than 10% that have substandard score. The credit score conditions will vary with regards to the lender your are working having nevertheless these apps are designed to agree individuals that have the average credit score.

Personal Financial Insurance

When you generate a deposit lower than 20%, you might be necessary to enjoys Personal Mortgage Insurance (PMI) near the top of your own typical homeowners’ insurance. PMI financing are acclimatized to provide the bank a promise within the situation a borrower defaults. PMI would-be factored into the payment and can are different in cost in accordance with the value of your property. It has to be also equivalent in cost to the typical homeowners’ rules.

Remember, new PMI connected to your https://paydayloancalifornia.net/herald/ financial shall be terminated as soon as your loan-to-really worth ratio are at 80%. When you build 20% collateral of your property, you could potentially contact the lender or provider of your financing to help you obtain it canceled.

Rates

To discover the best FHA interest, you will need to lookup and you can examine loan providers to see exactly who can offer a minimal. Rates is vary each and every day and it is crucial that you remain unlock communication together with your mortgage officer locate secured within the at a minimal speed.

FHA interest rates are also determined by a few personal facts, just like your credit history, debt-to-income ratio, and you may down-payment number.

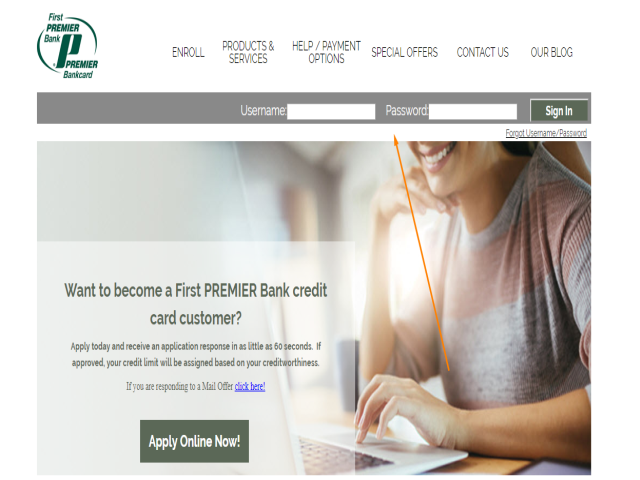

Because the a keen FHA recognized lender, Society Loans its thinks when you look at the homeownership for everybody. We have been inspired when you’re able to make our clients’ fantasies be realized. When you yourself have any questions regarding the qualification otherwise wants to begin the new homebuying procedure, reach out to us now!