NMLS # 274231 Amcap Mortgage, Ltd Organization NMLS ID# 129122 Elder Loan Officer within Silver Monetary Characteristics

FHA funds are good. With the together with side ‘s the lowest down-payment regarding step three.5%. You can lay a great deal more off but it’s not required. Without having loads of coupons you may rating the money you desire to suit your down-percentage and you will closing costs since a gift out of a close relative. And the provider try permitted to fork out in order to 6% of your own sales rate towards your closing costs and you may pre-paids. Owner cannot shell out more than exactly what the costs unquestionably are even though. Your minimal financing needs to be 3.5% of your own transformation rates, nothing where can come regarding the vendor. FHA is also more easy about borrowing from the bank facts than other financing applications is, but my favorite FHA feature is that the the FHA money are assumable. That means that if you decide to sell your property when you look at the the long term and you have an FHA mortgage at the a nice low rate, your own visitors can give you an all the way down-percentage and only dominate their lovely lowest payments, regardless of the rates of interest are performing at the time. They have to undergo an endorsement techniques but when they would, youre totally relieved of any responsibility off one mortgage.

Today into the payday loans Placerville not great features of your FHA loan. The greatest you’re home loan insurance rates. The lower price of FHA mortgage insurance policies will not give the whole story. The largest difference between a keen FHA mortgage is exactly what goes a very long time in the future. Especially, for many who put the called for step three.5% down on a thirty-season FHA mortgage, you will be trapped paying financial insurance rates for the entire title regarding the mortgage, no matter how the majority of the mortgage your paid back. Beforehand mortgage insurance is already at the step one.75%. That count gets extra onto the loan. Additionally there is an annual commission off 0.85%.

Today onto Outlying Innovation otherwise USDA. People terms and conditions try compatible. Your tune in to both since the United states Service out-of Farming promises the fresh financing. The good thing about that it mortgage is the fact there is absolutely no down-payment necessary! While the seller is actually allowed to pay-all reasonable and you can customary will cost you. Of course, if the supplier has not agreed to buy all of the closing costs, your ent finance, you are permitted to financing 100% of your own appraised really worth, anytime your residence appraises for more than the sales price, we can enhance your loan amount to fund certain or all of the of the closing costs.

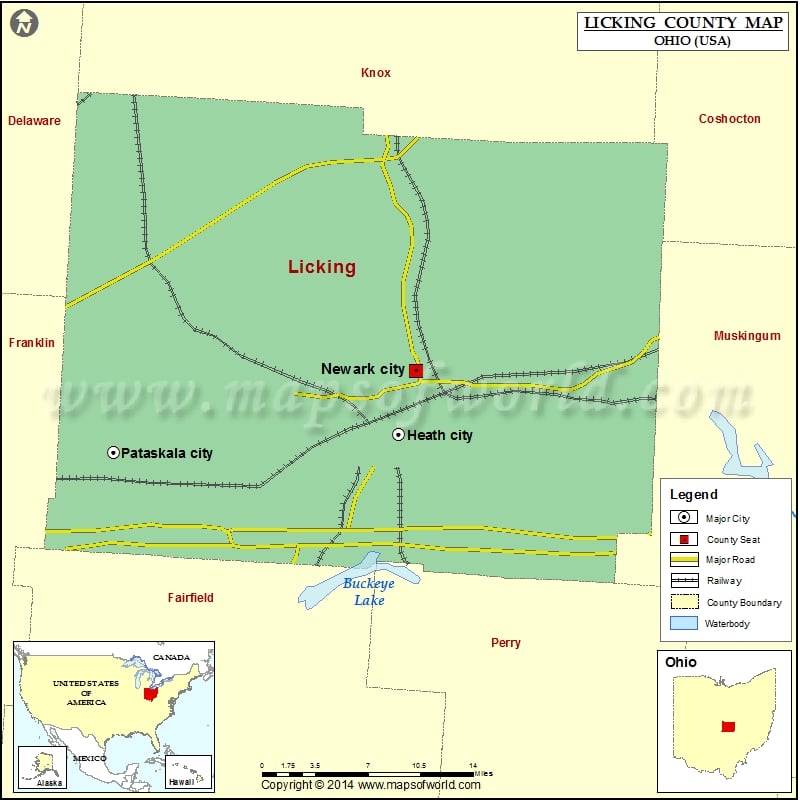

The drawbacks to a beneficial USDA loan is that the Be certain that Percentage from dos% will get placed into the loan number. Including, just as in FHA, there was an annual percentage regarding .5% and therefore will get put into their monthly installments. The biggest distinction is the fact with RD loans, same as FHA financing, you must bring you to mortgage insurance policies on life of new financing. Or you can re-finance. There is absolutely no prepayment punishment having either FHA or RD. There are also geographic and you will income constraints. You shouldn’t be perplexed by the title Rural Creativity. Oddly enough, they will not enable it to be people income promoting functions thus no farms. Outlying does not mean your possessions must be when you look at the the country often. To see if the property we wish to pick try in an approved area, only head to and put on the target.

Jason McKibbon

There’s a new highest difference between FHA and you can RD and this has to do with the money you owe. With FHA, for those who have a student loan you could show you to costs thereon mortgage are deferred for around 1 year immediately after closure, the newest payment up against you. On top of that when you are separated and your former lover helps make the repayments in your previous relationship domestic given that purchased from the split up decree, we won’t amount you to definitely against either you. Having Rural Development fund, in both of those circumstances, you would need to be eligible for brand new costs even although you do not make them.