Drifting in the place of fixed interest rates: And selecting the most appropriate sorts of financial for your things, you also need to take on drifting versus repaired interest rates.

A drifting (variable) rate of interest is go up otherwise slip any time, affecting your money. A predetermined interest (to possess between one and you may 5 years) means that the speed you have to pay on your financing are fixed on the totality of that months. The interest portion of your repayments doesn’t transform till the fixed-rates several months expires.

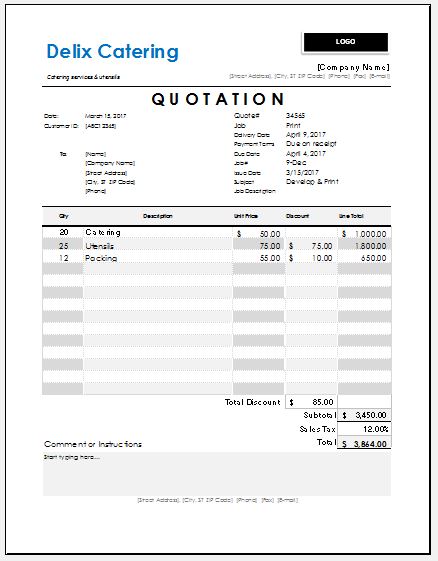

How big your mortgage varies according to the types of attributes considering. Pictures / Getty Photographs

They’re able to make you an obvious picture of what to anticipate from the bank before you sign the loan documentation

A common strategy to have home buyers is always to broke up home financing more than more than one repaired-price label, also to keep a portion toward a floating rates, that enables even more payments, repaying our home mortgage quicker.

If you find yourself being unsure of about and that financial options are perfect for your, your own financial adviser (broker) or cellular movie director will help choose the most appropriate to suit your financial circumstances.

No matter whether you are going head so you can a financial since your financial otherwise experiencing home financing adviser you’re going to you desire the second:

They will set you back an equivalent to accomplish the application with a mortgage agent or the bank’s mobile credit manager due to the fact doing it on the web.

When the supposed directly to the bank in place of through a home loan agent, definitely ask the bank regarding the interest, its costs, what you can do and then make transform toward mortgage just after create, and you may what are the results for individuals who break a predetermined-rate name.

You’re not restricted to credit from the lender. Research rates. When race is actually high anywhere between banks, you might tend to discuss the speed off otherwise have the application for the loan charges reduced.

For folks who actually have a home in-line, then it is a good idea to ensure you get your KiwiSaver withdrawal software during the at this time.

Generally of flash, Very first Household Withdrawal may take anywhere between 20 months and you can four months to work out. Very get the records to each other meanwhile as the opting for a lender. While you are unsure regarding the programs required for one to availableness their KiwiSaver money for choosing your first domestic, or you provides questions regarding the eligibility, click here to find out more.

Generally you need 2 weeks to three months into the financial to assess and accept your property application for the loan. Go back to the bank or mortgage agent far sooner than that.

If you find yourself obtaining a home loan while you’re mind-operating, you will have to have the following in addition important help paperwork:

It can sometimes be much harder to get a home loan if you are self-operating since the fundamental qualifications conditions is more suitable for group. If not qualify for home financing regarding a lender, home loan advisers can be put your providers which have option low-financial lenders. That always will come at the expense of a top interest.

Home buyers usually affect score pre-approved by a financial to locate a sense of their prospective to acquire title loans in NJ fuel and you can budget. This provides you a great deal more depend on to shop around for a home. It reveals so you’re able to real estate professionals and you will providers you are a serious consumer.

Pre-approval are a sign of what you could borrow in the event the financial approves of the property we would like to get. If the interest levels go up, loan-to-really worth percentages (LVRs) or any other laws transform, or if you try not to have the ability to accept within the pre-approval period, might probably must reapply having pre-approval. This might be one thing to feel really wary about when the to order in the public auction, heading unconditional toward one property, or to find out-of-the-bundle when the make could take more than asked.