Discover have a tendency to several requirements that really must be met in advance of a borrower normally re-finance their home ec-refinance-hl000061 . Eg, certain mortgage loans has actually an appartment several months before you will be permitted to pertain having refinancing otherwise to change your financial. And just particularly taking right out the first financing, there are many certificates pertaining to the fresh new borrower’s financial reputation – such as for instance losing inside a certain credit rating assortment. While worried your credit rating get impression your capability to refinance, there can be a number of an approach to nonetheless exercise.

What is actually a credit score?

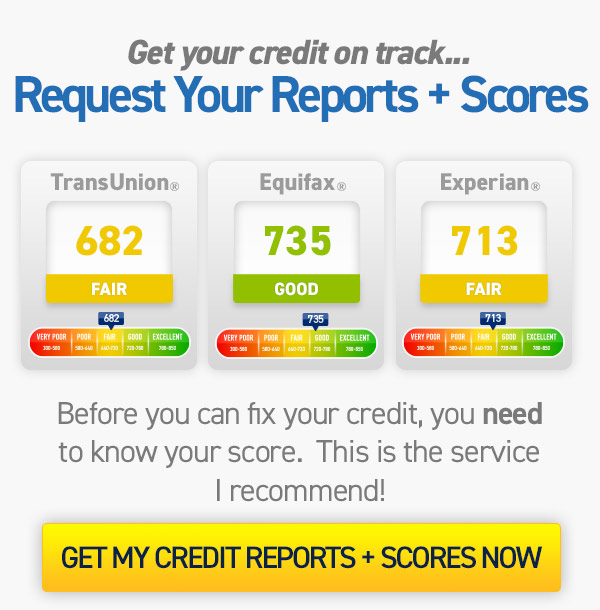

Your credit score try an excellent about three-little finger count which is computed based on your credit history. Credit ratings are priced between 300850 and certainly will getting classified away from bad so you’re able to advanced. Your credit rating is short for their creditworthiness – the fresh new the total amount to which a loan provider considers someone compatible to receive that loan, usually based on how reputable they are to invest it right back. Serve they to state, your credit rating carries several pounds when making an application for a loan, but it is not the thing one to identifies the loan qualifications. Prior to diving when you look at the, you could look at the credit rating knowing in which you sit.

Just what credit history is needed to refinance my personal financial?

There isn’t any you to definitely-size-fits-all of the method regarding exactly what credit rating you prefer to help you refinance your own home loan because utilizes the financial institution and what type of refinance you’re looking doing. The credit get you’ll need for a traditional financing refinance, such as for instance, looks distinct from the financing score you’ll need for an enthusiastic FHA fha-mentioned-hl000046 or Virtual assistant loan ec-va-hl000068 re-finance. Along with your credit score, there are many more issues that may help assistance your loan candidacy.

- Amount of family equity you have accumulated, also known as the loan-to-really worth ratio the new appraised worth of a property as opposed to the loan matter

- Significant investment supplies

In the event these types of other factors aren’t going to make it easier to refinance with a minimal credit history, they might service the application.

A way to refinance with a lower life expectancy credit rating

Those with lower credit ratings can get first battle to get a hold of a refinancing solution that works well in their mind. While you are in such a case, consult with your current lender. They may assist you to create an action bundle otherwise highly recommend examining some of the following:

Traditional compliant re-finance

The ability to re-finance and continue maintaining a traditional loan could be difficult that have a diminished credit rating since conventional financing want a beneficial so you’re able to great credit ratings to help you each other borrow and you may re-finance. Speak with your financial regarding your choices. You can even consider refinancing the old-fashioned mortgage getting an enthusiastic FHA loan for folks who qualify.

FHA rates and you will term refinance

FHA speed and you will title refinances usually are worth investigating if your credit rating has had a hit. That it change the loan identity and you may interest rate, that can help you spend less. These types of refinancing along with welcomes down fico scores than simply antique mortgages.

FHA improve re-finance

FHA streamline refinances are if you already hold FHA funds and would like to re-finance to lower their attention speed or remove the loan’s title size that have smaller records and less will cost you than simply a classic re-finance transaction. FHA streamline refinances don’t possess the very least credit rating demands, nonetheless they have criteria regarding mortgage payment record on the borrowed funds getting refinanced. Often times, lenders may require additional borrowing criteria above and beyond what’s needed because of the FHA, whether or not it is not normal because of it variety of program. credit-score-for-refinance_disc1

Virtual assistant loan refinance

For many who have a good Va financing and always see the new eligibility certificates, a beneficial Virtual assistant financing improve re-finance – known as mortgage Avoidance Home mortgage refinance loan (IRRRL) – is an opportunity to talk about.

- You have an excellent Virtual assistant mortgage, and you will

- You happen to be making use of the IRRRL to help you re-finance your Va loan, and you no credit check installment loans in Magnolia will

- You might certify you already live-in or used to live-in your house covered by the loan.

Total, Va finance generally speaking bring all the way down credit rating conditions and provide competitive rates versus FHA and you may antique finance. The brand new Virtual assistant re-finance program boasts an enthusiastic IRRRL including 100% cash out refinance alternatives.

The applying may reduce your monthly mortgage payments because of all the way down notice pricing or normally disperse the loan off a variable so you can an effective fixed interest.

Improving your credit rating

Since you research rates a variety of a method to re-finance that have good all the way down credit rating, consider working to replace your credit rating through the years immediately after which obtaining financing refinance later on.

Bottom line

The financing get needed to refinance a property depends on the brand new lender as well as the sorts of refinance you’re looking accomplish. When you are concerned with your credit score inside your qualifications, there are more actions which might be worth examining. Envision conversing with your lender to see exactly what solutions can get be available for your requirements.