Are a credit score off 570 a or crappy? So what does a credit history out-of 570 mean?

We certain not so great news to you. If you have a credit rating away from 570, you’ve got what exactly is experienced poor credit. In most cases, credit ratings below 619 receive the bad rates to your house financing, automotive loans and borrowing. The consequences can really bring a cost towards the a person’s lives therefore will be worse than just you think.

How much does which have a credit score away from 570 mean having household money, auto loans and you will credit cards? How can you raise a 570 credit history? Am i able to rating that loan with a credit rating regarding 570? We shall address all those questions and a lot more on this page.

Credit rating regarding 570: Car loans

To find a motor vehicle which have a credit score off 570 is achievable, but you may be most likely planning to possess an extremely high desire price and will you desire borrowing repair characteristics. Those with poor credit in the event the recognized for a financial loan will always offered large rates of interest than just people which have a cards get actually 80 activities greater than its rating. What’s the interest rate getting a credit rating out of 570 towards the a car loan?

The typical loan amount because of the automobile customers try $twenty-seven,000 based on Melinda Zabritski, Experian’s elder movie director out of automotive credit. When you factor in the three find common particular auto loans obtainable in myFICO’s loan savings calculator 36-times the latest car finance, 48-month the fresh new car finance and good sixty-week the latest auto loan you’ll receive smart away from exactly how much significantly more an automible mortgage will definitely cost for somebody having a credit history out of 570 versus a credit score regarding 650.

Therefore you happen to be advising myself one an enthusiastic 80 part difference between borrowing from the bank results contributes to a difference out of $cuatro,443 for the very same car?

Sure, that is what the audience is letting you know. Taking a car loan having an excellent 570 credit score is certian so you can charge you a whole lot more. Toward an effective thirty six times the latest car finance, you will be charged $dos,550 significantly more. Toward an effective forty-eight month, $3,491 so much more. On an excellent 60 day car loan, you will be charged you an astonishing $cuatro,443 much more.

Quite simply, if your scored converted to an effective 650 simply an enthusiastic 80 part upgrade you would save thousands of dollars on your mortgage. It’s worthwhile to expend a family particularly Contact Wade Brush Borrowing from the bank to displace your own credit prior to taking a drive.

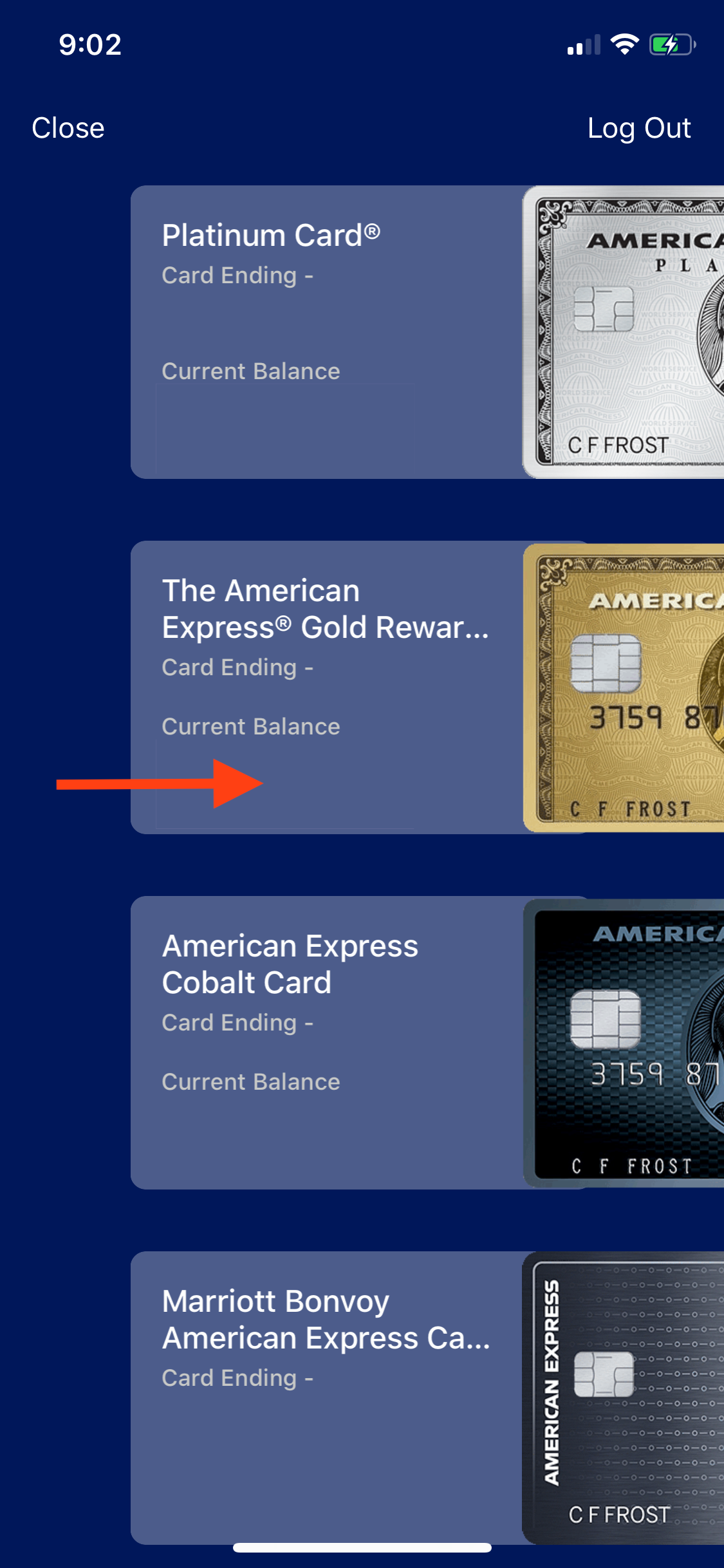

Credit rating regarding 570: Playing cards

What is the most useful mastercard getting a get off 570? Unfortuitously, if the credit history is actually a good 570, you will not be eligible for an unsecured charge card.

People credit history a lot more than 600 can get qualify for a keen unsecured credit according to the sort of mastercard you might be applying for. If your credit history starts with an effective 5 and you can ends in two amounts (70), you will just qualify for a guaranteed mastercard.

What is actually a protected bank card? This means that you will be expected to generate a minimum deposit to help you unlock your charge card. Wade Clean Credit continuously evaluates borrowing from the bank choices and you may already advises this type of Safeguarded Cards for people with a credit rating out-of 570.

We have seen doing a good forty area boost in borrowing score by starting one of them notes. What happens to your Annual percentage rate to have a credit rating off 570? Listed here is a chart illustrating the distinctions between annual fees and you can focus prices ranging from someone which have a good credit score and you can a credit score regarding 570.

Credit score from 570: Mortgage brokers

What if you are an initial time home client having a beneficial credit score off 570. Normally a credit score off 570 get a property?

For most mortgage loans you should be over an excellent 620 borrowing from the bank get, however, there are lots of finance available to choose from that go off so you can 570 to own FHA. But then other details get more difficult (existence personal debt to earnings) so it helps it be very difficult to meet the requirements less than 620.

Can you imagine that you may qualify for a FHA financing which have a credit score off 570. Because you will notice from the maps below, a minimal FICO score increases the sum of money you are going to end up shelling out for financing regarding the course of its lifetime. In the event the FICO rating is actually less than good 560, really loan providers will not even believe providing you a beneficial jumbo financing for an excellent FICO get that lower.

Note: The latest 30-season fixed jumbo home mortgage APR’s is actually estimated based on the pursuing the assumptions. Fico scores anywhere between 620 and you will 850 (500 and you can 619) guess a loan amount off $3 hundred,000, 1.0 (0.0) Affairs, a single Family unit members Owner Occupied Assets Kind of and you can an enthusiastic 80% (60-80%) Loan-To-Really worth Proportion.

Taking a home loan that have a credit score out of 570 could add a supplementary $68,040 throughout the mortgage than just anyone with a 721 credit score. The rate having a credit history regarding 570 increases the new month-to-month homeloan payment by the $222 more than anybody which have a rating 95 points highest, from the a credit rating regarding 675.

Simple tips to Increase A credit score regarding 570

How crappy is a credit history from 570? Once the we have noticed in the fresh new areas over, so it score impacts every aspect of your financial life. Mortgages, auto loans and you may charge card interest levels are common considerably higher than simply they will become should you have reasonable credit.

If you want to improve your credit score of 570, you can find methods do it.

1) Peruse this blog post on how best to Change your Credit history In a month. I record easy tips in this post instance repaying revolving stability to below 29% or any other information which can change your rating quickly.

2) Read through this blog post on what Not to would whenever restoring credit. The last thing you should do try flow in reverse during the your time and efforts to switch your own credit condition.

3) For many who positively need certainly to replace your credit score from inside the 30 days, might work with from the enlisting the assistance of a card fix business including Go Clean Borrowing. More resources for the credit repair software, excite e mail us.

Whatever the your position, Wade Clean Borrowing has a solution. I have of numerous borrowing from the bank fix programs that are available to greatly help you overcome your borrowing from the bank situation and set your straight back on the path to economic victory. Actual credit fix isnt an excellent immediately following proportions matches all the model and in addition we modify your needs to the right system, but most some body can begin just for $99 per month.

We have repaired price applications that get your right back focused within 5 days, debt resolution choices, programs aimed toward people with got present brief conversion otherwise property foreclosure and others. Assistance is just a free of charge phone call out you can also complete an appointment consult. Get in touch with Wade Clean Borrowing so you’re able to plan a free consultation now.