Mike Romano is actually a home loan world veteran with well over 2 decades of expertise. His assistance spans home loan tech, credit risk, and you will mortgage origination, and he has actually verbal from the of several home loan and you may fintech group meetings. They have a good Bachelor’s and MBA in the University from Ca, Berkeley and you can currently lives in Austin, Tx. NMLS # 2515901

Once you generate $60K a year, you’re likely inside the a decent position to order property. Yet, you might start asking inquiries instance: Basically create $sixty,000 a year, just how much house do i need to manage?

The answer is actually much more shorter state-of-the-art than you may consider. There’s way more to it than calculating simply how much you might be able to shell out inside the mortgage expenditures every month, however, there are not any awesome tricky data inside, possibly.

We will coverage all you need to understand affording purchasing a home which have good 60K income, and information regarding down-payment guidance and ways to optimize your home to purchase fuel.

We will explore it a whole lot more lower than, however, placing extra money upon your residence almost exponentially expands their limit family purchase price. And you might be eligible for many, if you don’t thousands of bucks to make that it possible.

Disclaimer: This post is to possess educational aim simply americash loans Knollcrest and should not getting considered as courtroom or monetary information. Please demand an attorney, lending company, or CPA to own tips on your specific state.

Basically build $sixty,000 per year, how much house can i afford?

There are private issues employed in determining just how much household you really can afford with a great 60K paycheck. Yet not, you might likely pay for a house between $147,two hundred and you can $338,100. Your own personal range can differ, however, this is a decent standard list of cost according to your revenue.

You can find circumstances you to impression exactly how much house you might manage that have a paycheck out-of $60K. We’re going to break apart all these things individually and have you all you have to understand:

- Debt-to-income proportion

- Advance payment amount

- Advance payment assistance

- Your geographical area

We will start by debt-to-income proportion, as you may assess they your self, and it’s among the many items you can control through personal finance planning.

Insights your debt-to-income ratio

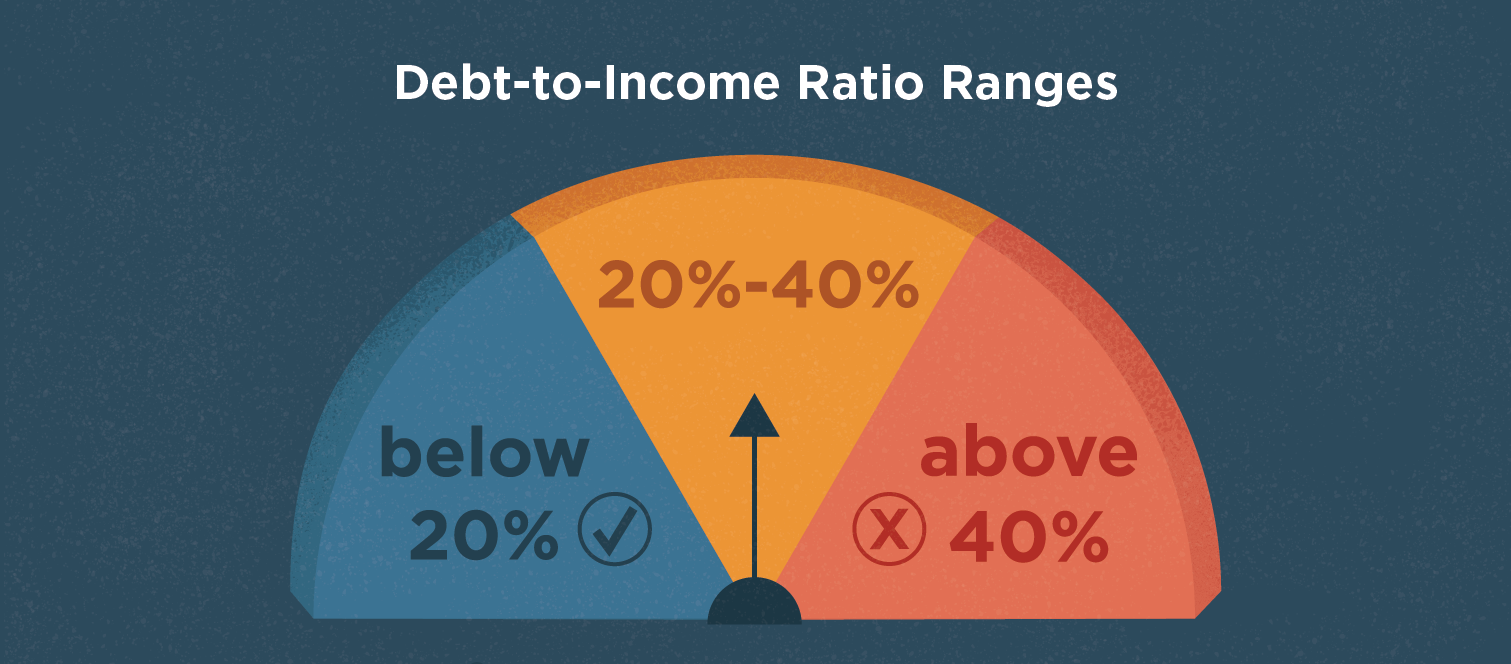

This basically means, the debt-to-money ratio is just one matter that presents what part of your income visits and come up with personal debt costs. Financing officers look at your loans-to-earnings proportion when they envision you to possess a mortgage since the they rapidly informs all of them regardless if you can afford the new mortgage costs.

The debt-to-income ratio was calculated of the separating your full personal debt costs because of the your disgusting monthly earnings. A good $60,000 annual income provides you with an effective $5,000 disgusting monthly earnings. To truly get your obligations-to-money ratio, you can easily divide the complete monthly financial obligation payments because of the $5,000.

Once you estimate your debt-to-money proportion, you’ll receive a number ranging from no and another. That it stands for what part of the month-to-month money visits your own personal debt costs.

A financial obligation-to-earnings proportion away from zero form you really have no month-to-month debt costs, and you can a debt-to-income ratio of one means that one-hundred percent of earnings would go to debt costs.

A diminished obligations-to-earnings proportion is perfect, for both yours earnings and also for getting a mortgage loan. not, that you don’t always you prefer a zero debt-to-money proportion discover an interest rate.

Brand new laws

Loan officials should explore obligations-to-income ratios, but the majority folks don’t think in our individual earnings inside these terms.

And then make anything convenient, we recommend making use of the laws, that’s a general guideline supported by really private financing masters.