For folks who set dollars into the escrow to be used with the upcoming assets taxation money, you will possibly not be able to deduct it money.

How to begin on the Refinancing

The taxation effects away from an effective refinance will likely be tricky. Before you choose to refinance, you may explore their plan which have an income tax professional and a mortgage specialist. Follow the actions below to get going to your refinancing.

- Be certain that a beneficial refinance can benefit you: Figure out what your aim try and whether or not refinancing may help you accomplish it. Often it decision save you money? Would be the current cost lowest adequate? If you choose an earnings-aside re-finance, make certain with so it money now outweighs the other years of financial obligation. Only you could understand what the right decision is for your, however, our very own financial advisers helps you consider the choices.

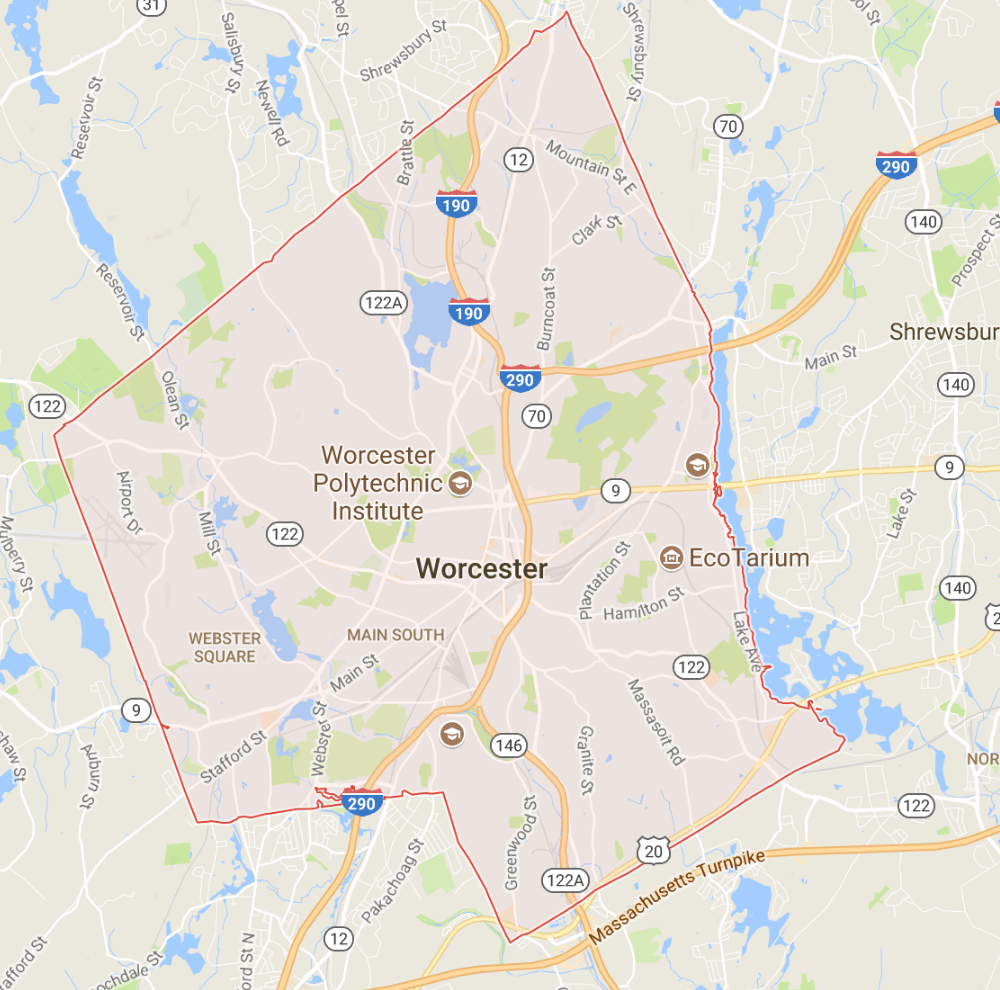

- Consult with a loan provider: For decades, Promise Monetary has been servicing mortgages to users. I make an effort to make the procedure for refinancing quick and easy. Continue reading

/fit-in/768x768/ListingFullAPI/RealogyMLS/NASHVILLE:2663717/bb52b7717a3bda082aa37ab2c62c4cbb?w=3840&q=75)