Once the possessions cost slide and you may rates go up, there are many measures individuals may use to ensure they are handling and you may taking advantage of changing criteria. Here are four methods for you to navigate the present day ecosystem and you will establish right up for long-term achievements.

Owning a home is certainly woven to the aspirations and you may lifetime desires out-of Australians, of course i see records, it’s obvious as to why. Property is a central element of training and you will determining their lifestyle, and as a secured item, it is an essential component out of family money across the country.

Another significant element of history to know is the fact that Australian property sector varies, meaning part of home ownership relates to acknowledging there is alterations in an effective property’s really worth throughout the years. Immediately, possessions prices are shedding, especially in cities for example Quarterly report and Melbourne. 1

That is where a lengthy-label therapy is a must. While the a borrower, you likely will have the pros and cons of your own Australian property markets, which is sensible so you can each other prepare your mindset as well as your financial on long term, says Carrie Fox, Direct regarding Household Credit on Macquarie Bank.

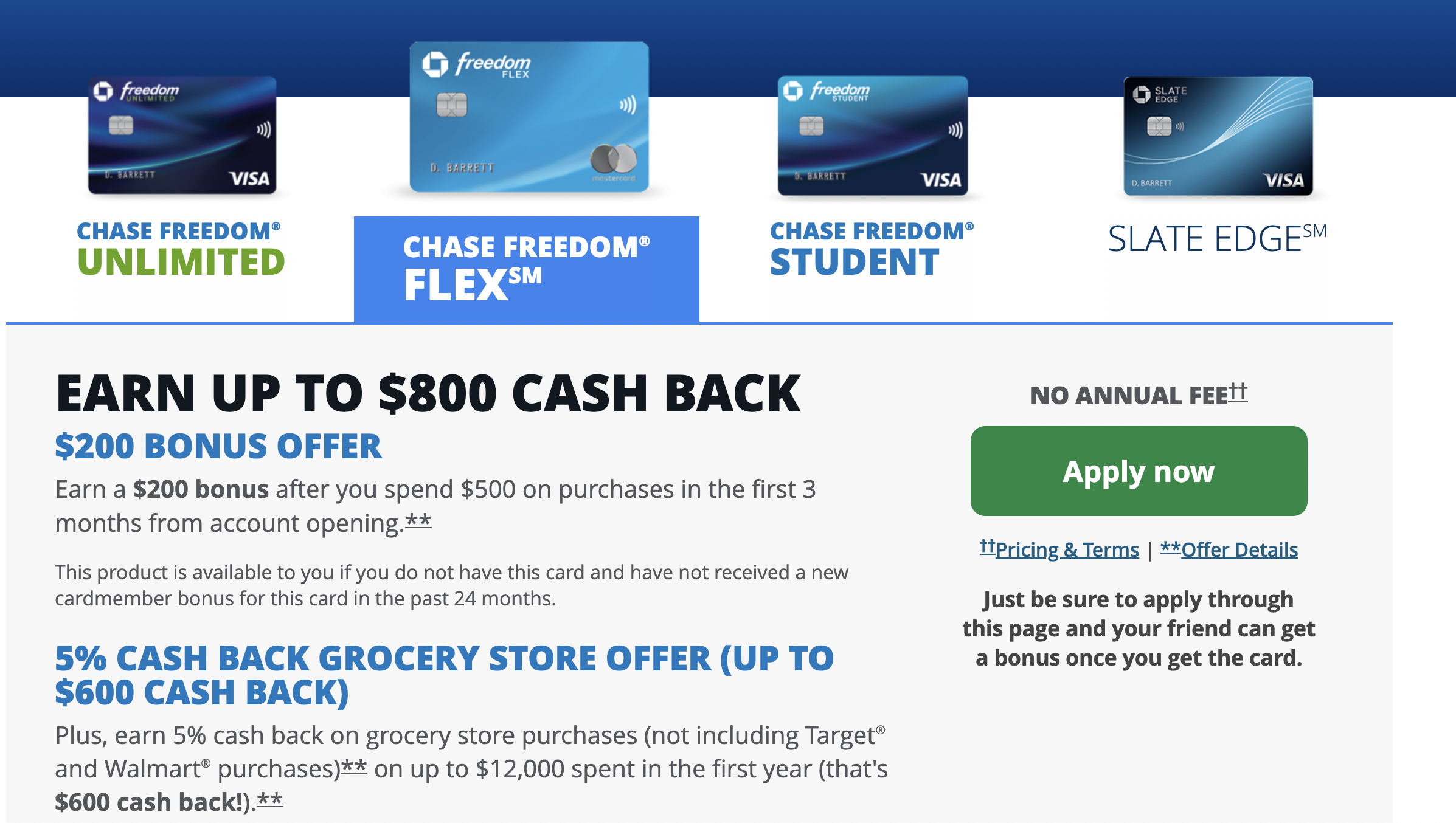

Such, honeymoon or basic interest rates are often only good to own an excellent capped period of time, meaning the advantage of a lower life expectancy rates could be small-stayed and ability to re-finance may possibly not be certain inside a modifying industry. Because of the evaluation rate (not just the brand new headline price) is even crucial, because this is a far greater meditation of will set you back across the life of your own financing. Continue reading